Aritzia (ATZ) posted solid financial results in its first quarter. The fashion retailer’s sales more than doubled despite the closure of the majority of its Canadian stores.

Revenue for Q1 2022 came in at C$246.9 million, an increase of 121.7% from the prior-year quarter, despite the closure of 34 out of 102 stores for approximately two-thirds of the quarter. E-commerce revenue grew 18.6% in the quarter ended May 30 to C$104 million.

Meanwhile, adjusted net income amounted to C$0.19 per diluted share, compared to a loss of C$0.23 per diluted share in the first quarter of the previous year.

Aritzia’s Founder, Chairman, and CEO Brian Hill said, “We are extremely pleased with the start of fiscal 2022. The strength of our multi-channel business fueled first-quarter net revenue growth of 122%, despite half of our Canadian boutiques remaining closed for the majority of the quarter. Driven by strong client response to our beautiful product assortment, our eCommerce revenues continued their positive trend, growing 19% on top of the 125% increase that we saw in the first quarter last year. Retail sales productivity at our open boutiques returned to pre-COVID-19 levels, ramping faster than we anticipated. In the United States, our brand affinity is deepening, where net revenues have more than tripled, growing at 200% from the prior year.”

For the second quarter, Aritzia expects net revenues to be between C$290 million and C$300 million, implying a 45 – 50% increase from last year. (See Aritzia stock charts on TipRanks)

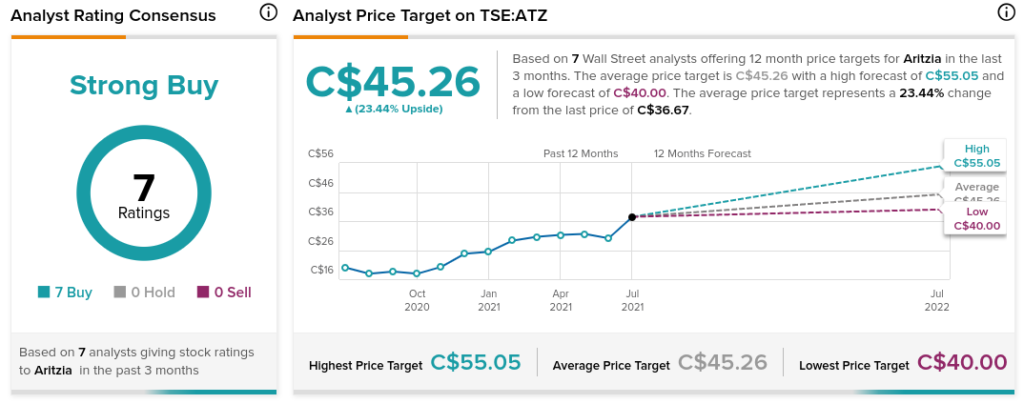

Following the results, Baird analyst Mark Altschwager reiterated a Buy rating on ATZ, while raising its price target to C$44.00 (from C$35.17). This implies 50% upside potential.

Altschwager stated that ATZ’s premium valuation is supported by a low growth runway and conservative guidance.

The rest of the Street is bullish on ATZ with a Strong Buy consensus rating based on 7 Buys. The average Aritzia price target of C$44.69 implies upside potential of 23.4% to current levels. Shares have almost doubled over the past year.

Related News:

Roots E-Commerce Sales Rise 50% in Q1; Shares Pop More Than 7%

Dollarama Q1 Sales Rise 13%, Misses Estimates; Shares Fall More Than 3%

Canada Goose Q4 Global E-Commerce Revenue Increases 123%; Shares Plunge 7%