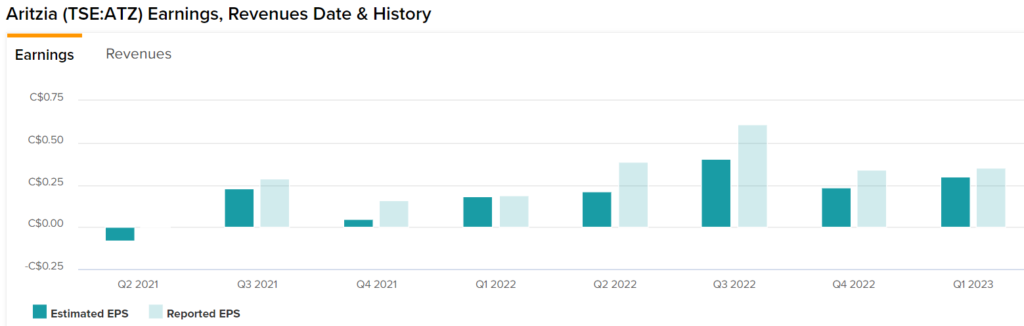

After the market closed yesterday, Aritzia (TSE: ATZ) reported stellar earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at C$0.35, above analysts’ consensus estimate of C$0.30.

In the past eight quarters, Aritzia has beat estimates each time. Investors may have become used to the company’s constant earnings beats, which would explain its muted 2.6% gain so far today.

In addition, sales increased 65.2% year-over-year, with revenue hitting C$407.9 million compared to C$246.9 million. It appears that the revenue increase was primarily driven by high consumer demand and strong momentum in the United States.

Most importantly, gross profit increased by 65.8%, meaning that the company was able to achieve operating leverage since it grew faster than revenue. Indeed, its gross profit margin expanded from 44.2% to 44.3%. This allowed the company to grow its net income by 85.8% versus the comparable period.

Insider Activity is Bullish

Looking at insider activity, there isn’t too much going on. Nevertheless, confidence from within appears to be very high, as one transaction, in particular, stands out from the rest. Aldo Bensadoun, a Non-Executive Director, purchased almost C$5 million worth of shares two months ago.

As a result, the Insider Confidence Signal for ATZ stock is positive and above the sector average.

Analysts’ Recommendations on Aritzia Stock

Aritzia has a Strong Buy consensus rating based on five Buys and one Hold assigned in the past three months. The average ATZ stock price target of C$59.34 implies 60% upside potential.

Final Thoughts – Things are Looking Bright

Aritzia saw a strong quarter, as revenue increased substantially while earnings came in better than expected. As a result, both analysts and insiders appear to be very confident in the company’s future.