Arista Networks forecasted better-than-expected sales for the first quarter after results topped consensus estimates in 4Q. Shares spiked 5.2% in Thursday’s extended trading session after closing almost 1% lower on the day.

The computer networking company’s 4Q revenues increased 17.4% year-over-year to $648.5 million and exceeded the consensus estimate of $628.93 million. Adjusted earnings surged 8.7% to $2.49 per share and beat the Street estimates of $2.39 per share.

Arista Networks’ (ANET) adjusted gross margin was 65%, down from 65.2% year-over-year.

Arista Networks CEO Jayshree Ullal said, “With our laser focus on customer success, pristine financials and transformative innovations, Arista is well positioned to continue our momentum in the post pandemic era.”

For the first quarter of 2021, revenue is expected to land between $630 million and $650 million, versus the consensus estimate of $610.4 million. The adjusted gross margin is forecasted to be in the range of 63% to 65%. Meanwhile, the adjusted operating margin is likely to be around 37%. (See Arista Networks stock analysis on TipRanks)

Following the 4Q results, Rosenblatt Securities analyst Ryan Koontz increased the stock’s price target to $385 (24.7% upside potential) from $360 and reiterated a Buy rating. The analyst believes the company is “poised to sustain its momentum, being well-positioned in the data center market and expanding traction in enterprise and service provider verticals.”

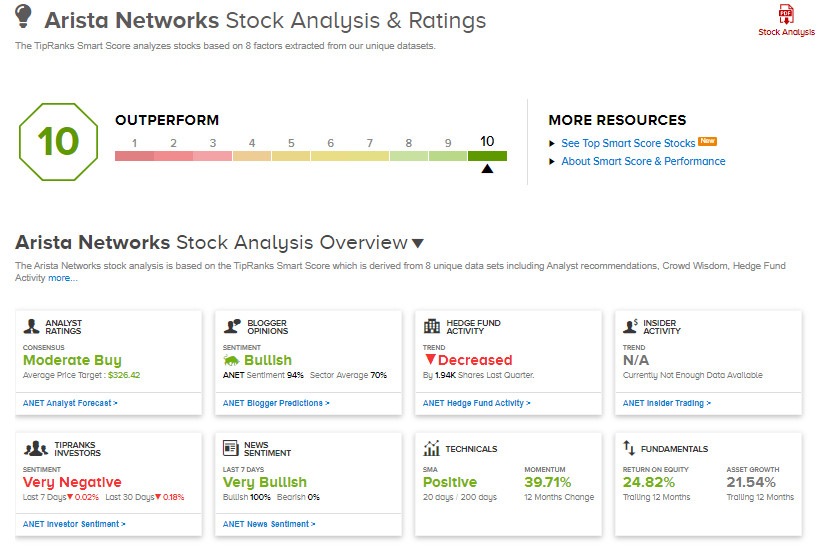

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 8 Buys and 5 Holds. The average analyst price target of $326.42 implies 5.7% upside potential to current levels. Shares have jumped about 43.6% over the past six months.

Arista Networks scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Analog Devices Posts Better-Than-Expected 1Q Earnings Amid Strong Chip Demand

Moody’s Posts Better-Than-Expected 4Q Revenue But Profit Disappoints

Lincoln Electric Posts Better-Than-Expected Quarterly Profit; Street Sees 5% Upside