Ares Management Corporation (NYSE: ARES) revealed that its subsidiary, Ares Holdings L.P., has inked a deal to acquire the PrivateMarketsCo Infrastructure Debt platform from Australia-based AMP Ltd’s Private Markets business for $308 million (A$428 million).

Markedly, shares of the U.S.-based global alternative investment manager operating in the credit, private equity and real estate markets have gained 66% over the past year.

Benefits of the Deal

AMP’s PrivateMarketsCo Infrastructure Debt platform is a leading global infrastructure debt investment platform with approximately $8 billion in assets under management (AUM) as of September 30, 2021.

With the deal, Ares’ combined Infrastructure AUM is expected to surpass $12 Billion across equity and debt strategies. The deal is expected to be immediately accretive to earnings and will complement Ares’ investment capabilities.

Furthermore, the addition of the Infrastructure Debt team will enhance Ares’ scaled global platform and its existing infrastructure strategy.

Notably, it will boost future investments, market intelligence as well as fundraising efforts to tap the fast-growing infrastructure asset class.

Other Details

The acquisition is expected to close in the first quarter of 2022, subject to certain regulatory approvals.

Upon completion, Infrastructure Debt will be reported as part of a new segment for Ares called the Ares Real Assets Group. The Ares Real Assets Group will represent $48 billion of AUMs adjusted for the transaction, as of September 30, 2021.

The company plans to fund the deal by utilizing available cash in hand as well as Ares’ US$1.1 billion revolving credit facility.

CEO Comments

Ares CEO Michael Arougheti commented, “We are pleased to announce this acquisition of a highly complementary infrastructure debt platform. We believe that this strategic combination will further propel our infrastructure investment capabilities and expand our global footprint,”

He further added, “Together we believe we are well-positioned to leverage the full scale of the Ares platform and relationships to provide optimal capital solutions for our investment partners and generate attractive risk-adjusted returns for our investors.”

Analysts Recommendation

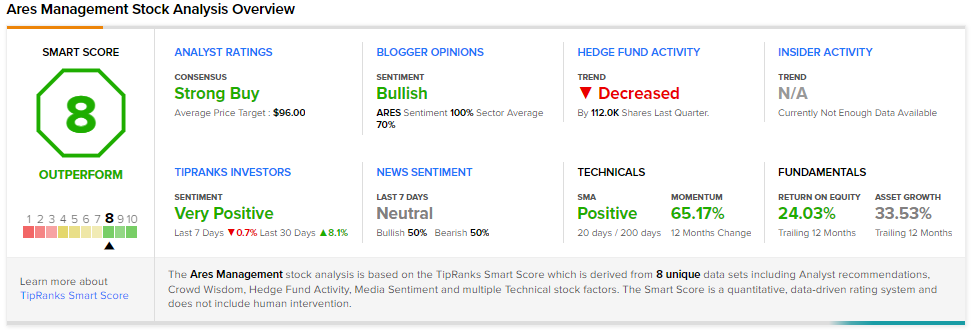

Overall, the stock has a Strong Buy consensus rating based on 5 Buys and 1 Hold. The average Ares Management stock prediction of $96 implies 17.99% upside potential from current levels.

Smart Score

Ares Management scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Carlyle to Snap up Involta; Shares Roar 4.9%

MSC Industrial Beats Q1 Earnings Expectations

Amazon’s Data Center Hit by Power Outage