ArcBest (ARCB) has inked a deal to acquire Chicago-based truckload freight brokerage MoLo Solutions, LLC. The acquisition makes ArcBest a top 15 U.S. truckload broker with access to over 70,000 carrier partners.

Markedly, shares of the provider of freight transportation services and solutions have gained almost 150% over the past year. (See ArcBest stock charts on TipRanks)

Per the terms of the deal, ArcBest will pay $235 million to MoLo Solutions from available funds. ArcBest will pay additional cash considerations conditional on meeting Adjusted EBITDA targets from 2023 to 2025 as mentioned by the company in its recent fillings.

MoLo, a third-party logistics company, has rapidly grown its customer base and revenue, outperforming industry benchmarks since its inception in 2017. In 2020, MoLo’s revenue grew 100% year-over-year to $274 million and expects to generate revenue of $600 million in 2021.

The addition of MoLo will double-up ArcBest’s available capacity, improve its ability to serve large customers across its suite of logistics solutions, drive higher revenues and earnings through cross-selling opportunities, and generate higher overall financial returns by leveraging economies of scale and operational synergies.

The acquisition is expected to close in the fourth quarter of 2021, subject to certain regulatory approvals.

The deal is expected to be accretive to earnings from the first full year of operations.

ArcBest CEO Judy R. McReynolds commented, “We are pleased to add MoLo’s significant capabilities and talent to our truckload brokerage offering, allowing us to better meet the critical needs of our customers, deliver comprehensive supply chain solutions and accelerate our company’s continued growth.”

She further added, “Since its founding four years ago, MoLo has built a strong foundation and reputation for excellence based on trusted customer and carrier relationships, as well as a proven ability to offer unsurpassed service. Since we began discussing a possible transaction several months ago, it became clear what a great fit MoLo was with ArcBest.”

Stifel Nicolaus analyst J. Bruce Chan recently increased the price target from $70 to $83 (8.1% upside potential) and reiterated a Buy rating on the stock.

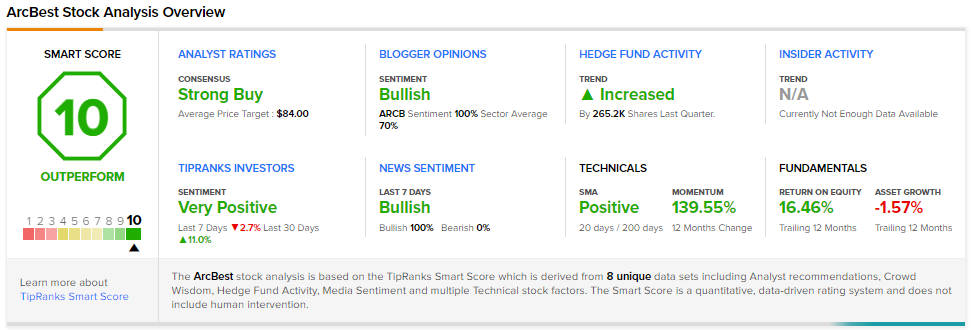

Overall, the Street is bullish on the stock and has a Strong Buy consensus rating based on 4 Buys and 1 Hold. The average ArcBest price target of $84 implies upside potential of about 9.4% from current levels.

ARCB scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Thor Industries’ Shares Leap 8% on Stellar Q4 Beat

United Airlines Partners with Airlink to Expand Travel Connectivity in Southern Africa

Ovintiv Launches 26M Share Buy-Back Program; Shares Rise