The COVID-19-induced supply chain woes in China continue to impact Apple (NASDAQ:AAPL). Last month, the iPhone maker had indicated that shipments of iPhone 14 pro could be impacted and now research firm Trendforce too expects the same.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Further, Trendforce also expects iPhone shipments to witness a significant drop in the first quarter as compared to earlier estimates (47 million devices in Q1 2023 indicating a 22% year-over-year drop).

Apple is also working on mitigating its sole supplier dependence and is planning to add a second manufacturer for the iPhone 14 pro device. Additionally, the company is also looking to double its output from India in 2023.

Separately, the company’s unit in Japan has been fined $98 million after it did not charge consumption tax for purchases of its offerings by foreign visitors to the country.

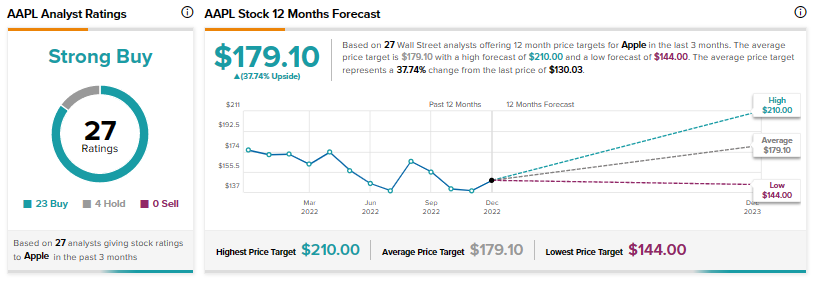

Analysts continue to remain buoyant about the tech juggernaut and have a Strong Buy consensus rating on the stock alongside an average price target of $179.10.

This indicates a 37.74% potential upside in the stock. That’s after a 27.9% price correction in AAPL shares over the past year.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

Read full Disclosure