Apple’s (NASDAQ: AAPL) App Store’s net revenue declined 5% year-over-year in the month of September, according to Morgan Stanley analyst Erik Woodring.

The analyst cited data from Sensor Tower and stated that this drop in revenues was “the worst decline in the history of the data.”

Woordring commented, “Compared to the month of August, net revenue growth decelerated across all of the App Store’s 10 largest markets (which make up 87% of App Store spend), except for China, Taiwan, and South Korea.”

By the analyst’s estimate, Apple’s total App Store net revenue was $6.4 billion, down 2.1% year-over-year.

Woodring added, “We believe the recent App Store results make clear that the global consumer has somewhat de-emphasized App Store spending in the near-term as discretionary income is reallocated to areas of pent-up demand.”

However, the analyst kept a Buy rating on the stock and a price target of $180. Woodring’s price target implies an upside potential of 27.6% at current levels.

Is Apple a Buy or Sell Now?

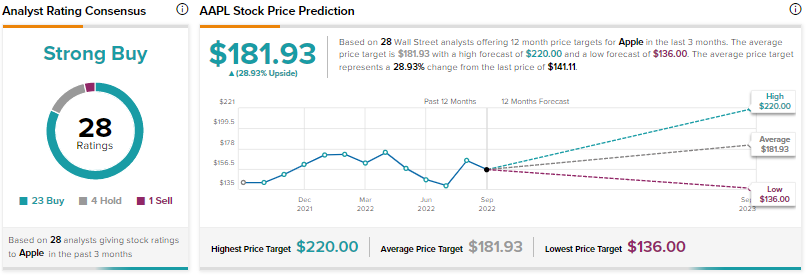

Analysts are bullish about Apple with a Strong Buy consensus rating based on 23 Buys, four Holds and one Sell.

The average price target for AAPL stock is $181.93 implying an upside potential of 28.9% on the stock.