Apple Inc is stepping up its self-driving car technology and is planning to produce a passenger vehicle by 2024 that could include its own breakthrough battery technology, Reuters has learnt.

According to the report, Apple (AAPL) seeks to build a vehicle for consumers and has a goal of building a personal vehicle for the mass market in contrast to rivals such as Alphabet Inc’s Waymo, which has built robo-taxis to carry passengers for a driverless ride-hailing service.

The sweet spot to Apple’s strategy is a new battery design that could “radically” lower the cost of batteries and increase the vehicle’s range, Reuters reported, citing a person who has seen Apple’s battery design. The iPhone maker plans to use a unique “monocell” design that bulks up the individual cells in the battery and frees up space inside the battery pack by eliminating pouches and modules that hold battery materials.

Plans for Apple’s automotive project, also known as Project Titan, have had a rocky start since 2014 when it first started to design its own vehicle from scratch. At one point, Apple scaled back the effort to focus on software and reassessed its goals. Doug Field, an Apple veteran who had worked at Tesla Inc, returned to oversee the project in 2018 and laid off 190 people from the team in 2019, according to Reuters.

Meanwhile, Apple shares have ballooned 75% this year as the coronavirus pandemic has created opportunities for companies like Apple who are weathering the crisis relatively well and are looking to increase their reach and boost market share. (See Apple stock analysis on TipRanks)

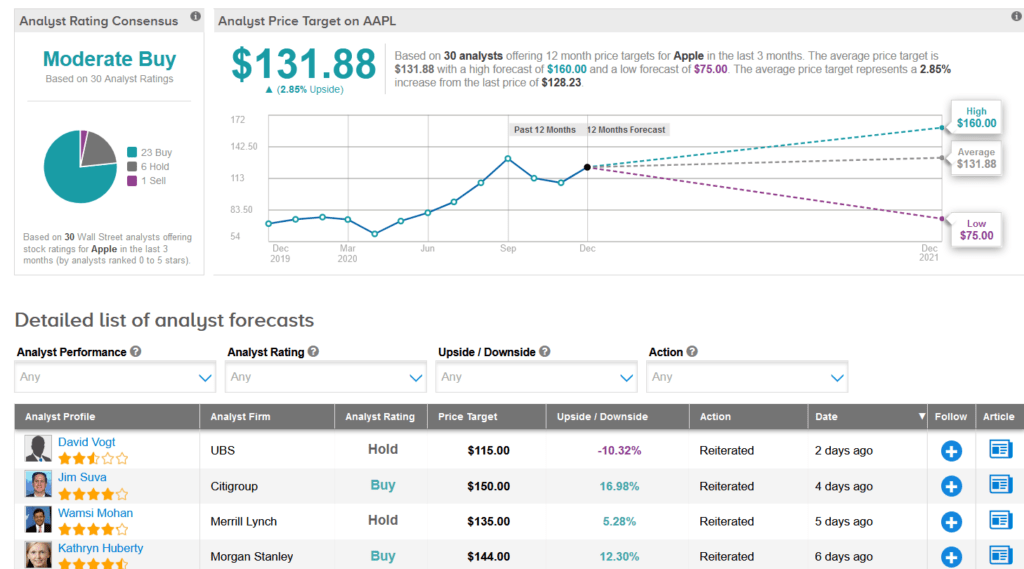

Looking ahead to 2021, Citigroup analyst Jim Suva is confident that Apple has more growth drivers coming and raised the stock’s price target to $150 (17% upside potential) from $125, while reiterating a Buy rating.

“Our estimate revisions are predicated on stronger-than-anticipated demand across several products including iPhones, Wearables and PCs/Tablets,” Suva wrote in a note to investors. “While December quarter demand is constrained by supply, we believe stronger-for-longer demand for Apple’s products prevails through fiscal year 2021 as the economy recovers.”

“Apple has evolved from a product company to a platform company that includes services such as software, storage, messaging. apps, advertising, music, TV and video content, digital payments, fitness, games, and many more. Looking ahead we believe Apple will not only continue to grow its services business but also get increased traction with the enterprise,” Suva summed up.

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 23 Buys, 6 Holds and 1 Sell. Meanwhile, the average analyst price target of $131.88 indicates upside potential of a more moderate 2.9% to current levels.

Related News:

Sportsman’s Warehouse Pops 37% On Great American Buyout Deal; Street Says Buy

Xpeng Starts EV Sale In Norway To Enter European Market

FCA Fines Charles Schwab UK £9 million for Failing to Protect Client Assets