Apple (AAPL) is looking at bringing additional memory chip suppliers on board for its iPhone product, according to a Bloomberg report. Although Apple is lately focusing on developing its services business, hardware sales remain its main source of revenue, especially the iPhone.

Apple has been sourcing iPhone memory chips from suppliers such as Samsung, Micron (MU), SK Hynix, and Kioxia. The company’s attempt to further diversify its memory supply chain follows an incident that seemed to be a wakeup call.

In February, Kioxia, a key supplier of the iPhone memory chip, was forced to stop production at two of its factories in Japan due to material contamination, according to the report. The problem at Kioxia could cause prices for certain memory chips to rise as much as 10% in Q2 2022, according to Trendforce estimates, leading to higher production costs for Apple.

Apple Considering a Chinese Memory Chip Supplier

Although the iPhone is assembled in China, Apple has long sourced memory parts for the product outside the country. But the Kioxia incident could see the company bring a Chinese memory supplier on board for the first time. Apple is considering Yangtze Memory Technologies and has even begun testing its sample products, according to the report.

What Does Apple’s Intention Mean for Investors?

Diversifying the supply chain further would allow Apple to reduce risks in its global manufacturing network. Bringing a Chinese memory chip supplier on board could unlock some cost-savings benefits for Apple as it would be obtaining the critical components closer to where iPhones are assembled. Cutting costs could lead to more profit, which could in turn benefit Apple’s share repurchase and dividend programs.

Wall Street’s Take

On March 30, Bank of America Securities analyst Wamsi Mohan reiterated a Buy rating on Apple with a price target of $215, which indicates 23.1% upside potential. The analyst believes there is strong demand for the iPhone, pointing out survey results that showed that 25% of iPhone users still have old devices and may need to upgrade to the latest model.

Consensus among analysts is a Strong Buy based on 23 Buys and five Holds. The average Apple price target stands at $193.36 and implies upside potential of about 10.7% to current levels. Shares have gained 23% over the past six months.

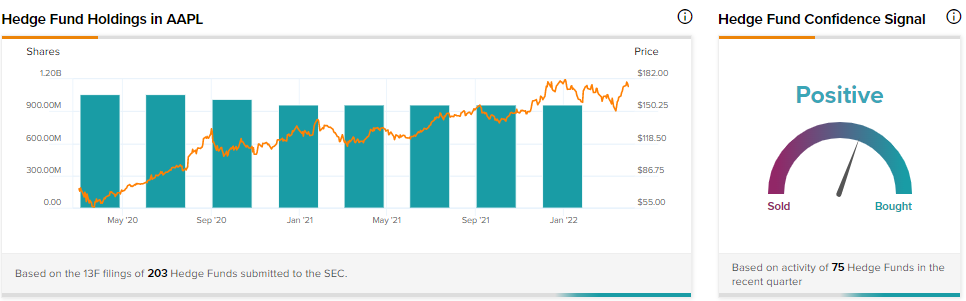

Hedge Funds

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in AAPL is currently Positive, as 75 hedge funds increased their cumulative holdings of the stock by 770,100 shares in the last quarter.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure