Apple (AAPL) is ramping up its efforts to take on Walt Disney (DIS), Netflix (NFLX), and Amazon (AMZN) in the content streaming business. Citing The Information, Reuters reported that the iPhone maker intends to spend more than $500 million in marketing its streaming service Apple TV+ this year. AAPL shares fell 3.31% to close at $148.97 on September 10.

Apple is a technology company that designs, develops, and sells smartphones, personal computers, tablets, wearables, and accessories.

In addition to marketing Apple TV+, Apple also intends to bolster its content library with new TV shows and movies. The company plans to release at least one show or movie a week next year, more than double what it currently releases. (See Apple stock charts on TipRanks)

Apple’s push to spend more than $500 million does not come as a surprise. Its streaming service is under pressure now more than ever. Established players like Netflix and Walt Disney+ pose significant competition.

Recently, Monness analyst Brian White reiterated a Buy rating on the stock with a $184 price target, implying 23.51% upside potential to current levels.

According to the analyst, significant updates to the iPhone 13 are on the line and should be more incremental compared to enhancements on the iPhone 12 series.

Given that new iPhones often include a faster processor and an enhanced camera system, the analyst expects all four new iPhone 13 models to include a new A15 Bionic chip.

White stated, “Given an improved economy, expanded 5G coverage, and low 5G smartphone ownership, we expect the iPhone 13 family to receive an enthusiastic reception.”

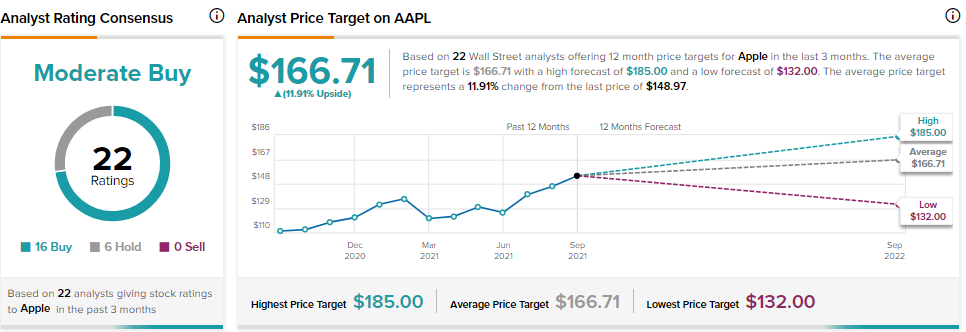

Consensus among analysts is a Moderate Buy based on 16 Buys and 6 Holds. The average Apple price target of $166.71 implies 11.91% upside potential to current levels.

Related News:

Roots Posts C$1.2M Loss in Q2; Shares Pop 3%

Taking Stock of Intellinetics’ Risk Factors

Affirm Posts Mixed Q4 Results; Stock Surges 20.7%