Apple Inc.’s (NASDAQ:AAPL) CEO Tim Cook is planning to diversify the tech giant’s chips supply chain by sourcing some of the requirements from a plant in Arizona and possibly from Europe as well. The news was first reported by Bloomberg, which cited an internal meeting held with local engineering and retail employees in Germany. AAPL’s move will reduce its reliance on Asia-produced chips.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The concerned plant in Arizona is currently under construction and is expected to start manufacturing in 2024. Reportedly, Taiwan Semiconductor (NYSE:TSM), Apple’s chips supplying partner, is setting up a new plant in Arizona.

The report states that considerable investment in capability and capacity in both the United States and Europe can be expected as the U.S. and European Union have passed chips-related acts with a view to encourage domestic manufacturing of semiconductors.

Apple’s decision to diversify its chips supply chain is expected to reduce its reliance on Asia, specifically Taiwan. Persistent chip shortages impacted Apple and other manufacturers in 2021 and this year as well.

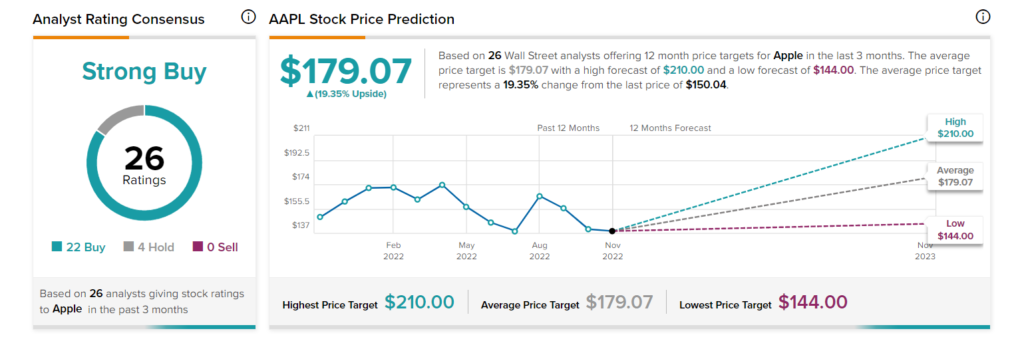

What is the Target Price for Apple Stock?

The average AAPL stock price target of $179.07 implies 19.35% upside potential from current levels. At TipRanks, Apple has a Strong Buy consensus rating based on 22 Buys and four Holds.