Apple (AAPL) is planning a major shift in how it provides financial services to customers as its ambitions in the sector grow. According to a Bloomberg report, the company is building its own financial infrastructure, which would eventually see it drop some outside partners.

The company’s interests in owning the infrastructure that underpins its financial products are broad. Apple is looking at taking control of everything from payment processing to credit checks and fraud analysis, according to the report.

It may be looking to break free of outside partners to gain more control of its product roadmap. For example, Apple may be able to introduce new products and enter additional countries more quickly if it is no longer limited by partners’ ability, according to the report.

Apple to Build Future Financial Products on Its Own Infrastructure

Apple’s current financial products such as Apple Card and installment payment plans for device purchases are supported by partners such as CoreCard (CCRD), Green Dot (GDOT), and Goldman Sachs (GS). But Apple’s upcoming credit plan, which will let customers buy items and pay for them later in installments with Apple Pay, may rely more on the company’s in-house technology. The company has more financial products in the pipeline, and those may also use less outside technology.

What Does This Plan Mean for Apple’s Stock?

Taking control of its financial system may allow Apple to make more money from its financial products by cutting out some middlemen. It may also be able to grow its services revenue more rapidly by being able to accelerate product launches and expansion to new markets.

Apple is counting more on its services business as growth in its flagship hardware business has mostly slowed. In fiscal Q1 2022 ended December 25, Apple’s services revenue jumped 24% year-over-year to $19.5 billion. In contract, iPhone revenue increased only 9% to $71.6 billion.

While building an in-house financial system may serve Apple’s interests, the plan could cause tensions with existing partners and result in delays in its rollout.

Wall Street’s Take

On March 29, Morgan Stanley analyst Kathryn Huberty maintained a Buy rating on Apple with a price target of $210, which indicates 18% upside potential. The analyst believes that Apple customers could spend more with the company if it introduces the anticipated subscription device purchase option.

Consensus among analysts is a Strong Buy based on 23 Buys and five Holds. The average Apple price target stands at $193.36 and implies upside potential of 8.8% to current levels. Shares have gained 25% over the past six months.

Stock Investors

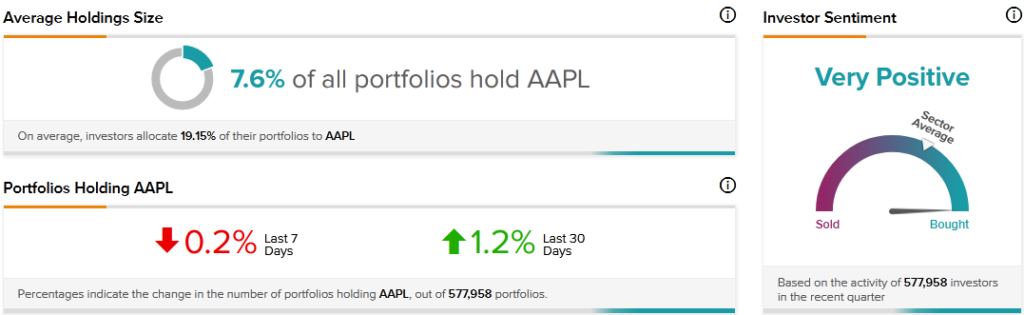

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Apple, with 1.2% of portfolios tracked by TipRanks increasing their exposure to AAPL stock over the past 30 days, at the time of writing.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

UiPath Declines 14% Despite Upbeat Q4 Results

Wix’s DoorDash Integration to Empower Restaurants

Solo Brands Delivers Q4 Beat; Shares Up 10.2%