APi Group Corporation, a commercial life safety solutions and industrial specialty services provider, reported better-than-expected 4Q earnings. However, adjusted revenues came in below expectations, impacted by the pandemic.

APi Group (APG) reported 4Q adjusted earnings of $0.34 per share that surpassed analysts’ expectations of $0.31 but declined 5.6% year-over-year. Meanwhile, adjusted net revenues of $874 million missed the Street’s estimates of $875.04 million and dipped 5.5% from the year-ago period.

The company’s adjusted gross margin was 25.4%, up 183 basis points year-over-year, while adjusted EBITDA came in at $103 million, down 5.5%. (See APi Group stock analysis on TipRanks)

APi Group CEO Russ Becker commented, “End markets that we serve such as data centers, fulfillment and distribution centers, high-tech and healthcare have continued to show their resilience throughout the pandemic, similar to the resilience shown by our business. We remain focused on achieving our pre-COVID-19 objectives and long-term value creation targets.”

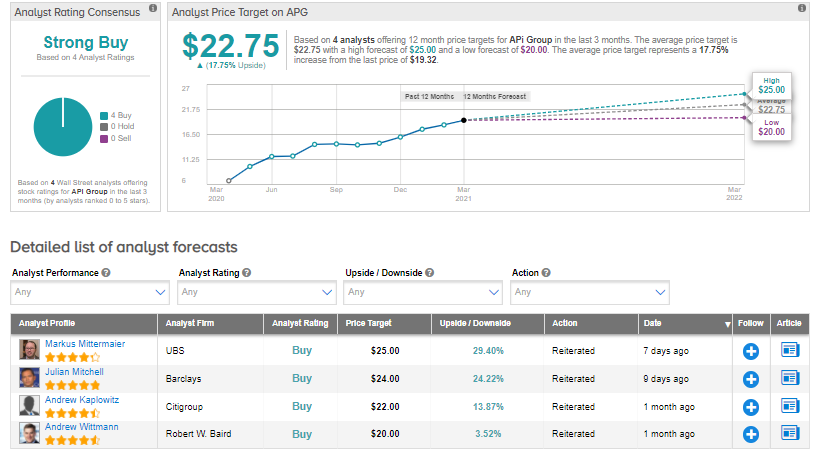

On Feb. 16, Citigroup analyst Andrew Kaplowitz increased the stock’s price target to $22 (14% upside potential) from $21 and reiterated a Buy rating as the company continues to perform well.

APi Group shares have skyrocketed 227.5% over the past year, while the stock still scores a Strong Buy consensus rating based on 4 unanimous Buys. That’s alongside an average analyst price target of $22.75, which implies almost 18% upside potential to current levels.

Related News:

Ametek Inks Deal To Acquire Abaco Systems For $1.35B

Embraer Posts Smaller-Than-Feared Quarterly Loss; Shares Pop 7%

FDA Accepts New Drug Application For Bristol Myers Squibb’s Mavacamten