Cloud-based planning platform provider Anaplan, Inc. (PLAN) recently posted better-than-expected performance for the third quarter, with its top-line and bottom-line exceeding analysts’ estimates.

Growth in Subscription revenue helped the company’s Q3 revenue grow by 35.2% over the prior year to $155.3 million. Similarly, net loss per share at $0.05 exceeded analysts’ estimates by $0.06.

Furthermore, Anaplan’s remaining performance obligation increased 24.8% year-over-year to $923.2 million. With these positives in mind, let us take a look at the changes in Anaplan’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Anaplan’s top risk category is Finance & Corporate, contributing 38% to the total 56 risks identified. In its recent quarterly report, the company has changed two key risk factors.

Under the Ability to Sell risk category, Anaplan highlighted that to a large degree its success hinges on continued growth in demand for cloud-based Connected Planning and Digital Transformation Solutions, and Anaplan’s ability to harness this demand.

If the market for Connected Planning solutions does not grow, grows slower than anticipated, or shrinks in size, then Anaplan’s business could be adversely affected.

Under the Macro & Political risk category, Anaplan noted that the present COVID-19 pandemic and the consequent global economic uncertainty has affected its operations, its customers, and partners. This could lead to a material adverse impact on Anaplan’s business, financials, and operating results. (See Insiders’ Hot Stocks on TipRanks)

Compared to a sector average of 14%, Anaplan’s Ability to Sell risk factor is at 21%.

Wall Street’s Take

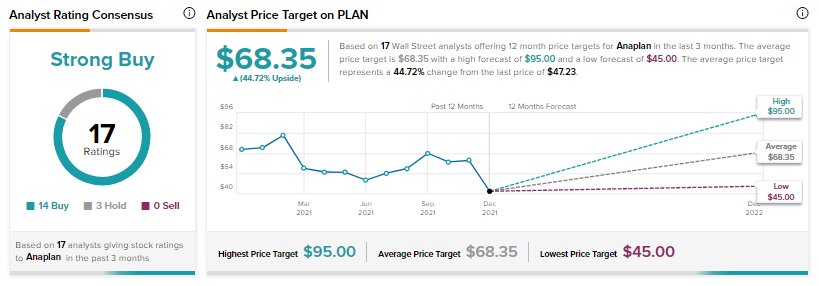

Consensus on the Street is a Strong Buy based on 14 Buys, and 3 Holds for the stock. The average Anaplan price target of $68.35 implies a potential upside of 44.7% for the stock. That’s after a 24.7% drop in Anaplan’s share price over the past month.

Related News:

Dollarama Q3 EPS Rises 17.3%, Beats Estimates

Visa Launches Crypto Advisory Services

DraftKings, NFLPA to Launch Gamified NFT; Shares Rise 2%