Uber Technologies (UBER) is an American multinational ride-hailing provider. It also offers food delivery services under the Uber Eats brand, as well as a freight platform that connects carriers with shippers.

For Q4 2021, Uber reported an 83% year-over-year jump in revenue to $5.8 billion and surpassed the consensus estimate of $5.3 billion. It posted EPS of $0.44, which improved from a loss per share of $0.54 in the same quarter the previous year and beat the consensus estimate of a loss per share of $0.35.

The company ended the quarter with $4.3 billion in cash and cash equivalents.

With this in mind, we used TipRanks to take a look at the risk factors for Uber.

Risk Factors

According to the new TipRanks Risk Factors tool, Uber’s top risk category is Finance and Corporate, with 16 out of the total 61 risks identified for the stock. Legal and Regulatory and Production are the next two major risk categories with 15 and 10 risks, respectively. Uber has recently introduced a new Macro and Political risk factor and updated several previously outlined risk factors.

In the newly added risk factor, the company cautions about the potential adverse effects of climate change on its business. Uber explains that in response to climate change, it has committed to certain emission reduction targets. For example, the company is working toward transitioning its U.S. offices to 100% renewable electricity by 2025. Additionally, it aims to achieve net-zero emissions across its corporate operations by 2030 and become a net-zero company by 2040.

In addition to internal commitments, Uber says it is subject to various climate regulatory requirements. It mentions California’s regulation that requires that 90% of rideshare miles in the state be in electric vehicles by 2030.

The company explains that achieving its own climate goals and meeting regulatory demands would require expending significant resources. Yet the success of such efforts cannot be guaranteed because they are subject to many factors beyond the company’s control. Therefore, Uber warns that its business and reputation may be adversely impacted if it fails to achieve its climate goals and obligations.

In an updated Legal and Regulatory risk factor, Uber informs investors that it is subject to various government probes in the U.S. and abroad. Those probes touch on a wide range of matters, such as the company’s business practices. The company explains that dealing with those investigations requires significant financial resources and management time. It warns that adverse outcomes from the probes may subject it to additional fines, penalties, and sanctions. Moreover, the company could suffer significant financial damages and harm to its business and reputation.

Uber stock has declined about 20% year-to-date.

Analysts’ Take

Truist Securities analyst Youssef Squali recently reiterated a Buy rating on Uber stock with a price target of $65, which suggests 85.82% upside potential.

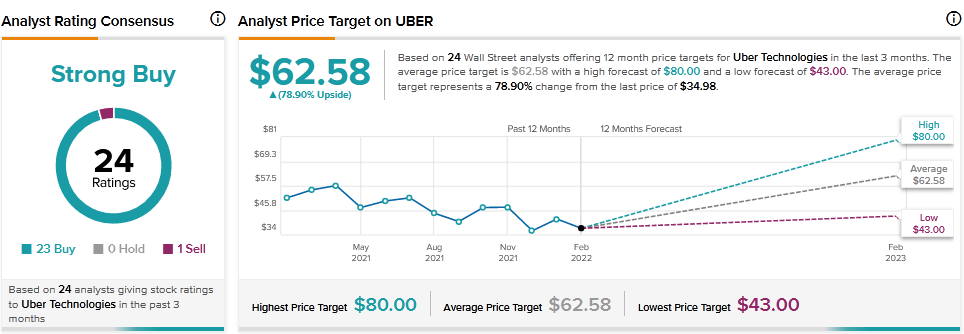

Consensus among analysts is a Strong Buy based on 23 Buys and 1 Sell. The average Uber Technologies price target of $62.58 implies 78.90% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Scotiabank Q1 Earnings Preview: What to Expect

BMO Q1 Earnings Preview: What to Expect

CWB Q1 Profit Rises 11%, Beat Estimates