As we move into the final stretch of the year, stocks continue to grind higher, with the S&P 500 now up 16% year-to-date. Once again, it’s Big Tech leading the charge – the mega-cap innovators powering enthusiasm around AI, cloud technologies, and next-gen digital infrastructure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, the market’s strength at the top doesn’t mean opportunity is confined to the trillion-dollar club. In fact, while the giants dominate headlines, some of the most compelling setups can emerge at the opposite end of the market spectrum. Down in the penny-stock arena – where shares trade under $5 – investors can find names with the potential for massive upside.

Of course, that potential cuts both ways. Low share prices can signal early-stage growth stories with meaningful runway – or companies facing fundamental challenges. Distinguishing between a promising under-the-radar contender and a value trap demands careful due diligence.

That’s where Wall Street analysts earn their stripes, digging into fundamentals, market dynamics, and upcoming catalysts to uncover smaller names with the potential to grow into far more valuable investments.

With that backdrop, we used TipRanks’ database to pinpoint two penny stocks earning high conviction from the Street right now. Both hold ‘Strong Buy’ consensus ratings and offer triple-digit upside potential – including one name with room to rally nearly 550%. Let’s take a closer look at why analysts see these picks as primed for gains.

Acrivon Therapeutics (ACRV)

The first penny stock on our radar today is Acrivon Therapeutics, a clinical-stage biotech working to take precision oncology to the next level. The company uses its proprietary Generative Phosphoproteomics AP3 platform – essentially a system that measures how cancer cells react to specific drugs – to figure out which patients are most likely to benefit from a given therapy, and its OncoSignature companion diagnostic helps identify which tumors are most likely to respond. In practice, AP3 digs into huge amounts of proteomic data, turns it into structured insights, and taps generative-AI tools to help guide targeted drug development and smarter treatment decisions.

Following this approach, Acrivon has advanced two drug candidates into human clinical trials. Its lead program, ACR-368, is a selective CHK1/CHK2 inhibitor being evaluated in a registrational-intent Phase 2b trial for patients with recurrent, high-grade endometrial cancer who have progressed after platinum chemotherapy and immunotherapy. Early clinical readouts from the trial have been encouraging. Among patients identified as OncoSignature-positive, ACR-368 has delivered substantially higher response rates versus biomarker-negative patients, including durable responses in heavily pretreated disease settings.

ACR-368 has earned FDA Fast Track designation as a monotherapy in ovarian and endometrial cancer, while Acrivon’s companion OncoSignature test for ACR-368 has also received Breakthrough Device status. The company recently added a third arm to the trial, pairing ACR-368 with ultra-low-dose gemcitabine in a broader, biomarker-unselected endometrial cancer group, and it expects to share an update on the confirmatory trial design by year-end.

At the same time, Acrivon is advancing its second clinical-stage asset, ACR-2316, a dual WEE1/PKMYT1 inhibitor designed to destabilize tumor cells by blocking key DNA-damage repair pathways. The therapy is currently moving through an ongoing Phase 1 monotherapy dose-escalation study across solid tumors. Preclinical data showed strong single-agent activity, and early clinical experience has already produced an ongoing confirmed partial response in a patient with endometrial cancer. Acrivon expects to share initial clinical data from this trial by year-end, marking a significant upcoming catalyst for the stock.

With ACRV shares changing hands at $1.99 and ACR-2316’s readout on the horizon, Citizens JMP analyst Silvan Tuerkcan sees a compelling setup for investors.

“ACR-2316 data is a significant event for ACRV, which is currently trading at negative EV and has cash runway into 2Q27. A positive emerging profile of ACR-2316 could be worth ~$150M in market cap, in our opinion… We are seeing signals from the competitive landscape that the dual-targeting approach [WEE1 and PKMYT1] has best-in-class potential… The ACR-2316 mechanism is differentiated from the field and has the potential to improve where others have faltered. Acrivon has hinted at a positive tolerability profile, and we will get a better picture of the profile by year-end,” Tuerkcan noted.

As for ACR-368, the analyst sees plenty to like there as well, noting: “The ACR-368 update earlier this year continues to point to an intriguing profile in mEC, where not many options exist. While ORR dropped to 35%, this result, along with the mDoR, is competitive in this setting and especially considering the enrolled population… Acrivon carved out several subgroups that performed particularly well, including biomarker positive patients that had relapsed in the prior line and treatment refractory tumors, which are generally associated with exceedingly poor prognoses.”

Putting it all together, Tuerkcan rates ACRV an Outperform (i.e., Buy) with a $13 price target, implying a robust 553% upside from current levels. (To watch Tuerkcan’s track record, click here)

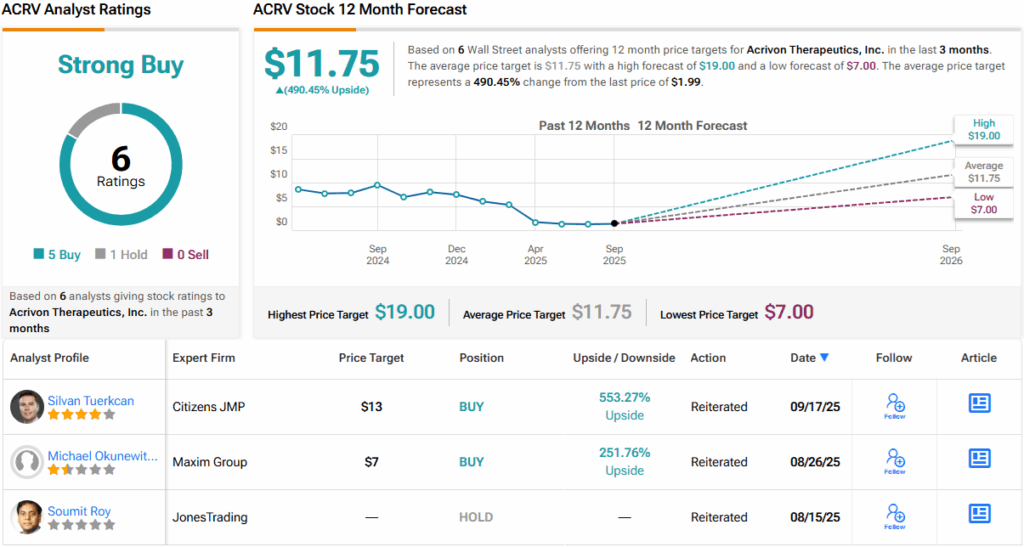

The broader Street stance reinforces that confidence. Over the past three months, ACRV has received 6 Buy ratings and just 1 Hold, earning a Strong Buy consensus. The average price target stands at $11.75, pointing to a potential 490% upside over the next year. (See ACRV stock forecast)

VistaGen (VTGN)

Up next is VistaGen, a clinical-stage biopharma aiming to reshape how central nervous system disorders are treated. The company is primarily focused on anxiety-related conditions, led by its intranasal therapy for social anxiety disorder. In addition, VistaGen has programs targeting major depressive disorder and women’s health indications like hot flashes. By advancing differentiated neuroactive compounds, the company is pursuing a novel approach to conditions that have long lacked effective and well-tolerated treatment options.

The most advanced program in VistaGen’s pipeline is fasedienol, which is being evaluated as a treatment for social anxiety disorder (SAD). Fasedienol is an intranasally dosed drug used as an acute treatment for SAD in adult patients. The PALISADE program, the set of clinical studies examining fasedienol, has been underway for several years now, and the PALISADE-3 and PALISADE-4 Phase 3 trials are both nearing key milestones. The first of them is expected to release topline results during 4Q25, and the second is scheduled to release its own topline data during 1H26.

Fasedienol demonstrated encouraging signals in earlier clinical trials, with Phase 2 and Phase 3 data showing statistically significant reductions in anxiety symptoms during real-world stress challenges, alongside meaningful improvements on clinician- and patient-reported functioning. While one earlier Phase 3 study, PALISADE-1, did not meet its primary endpoint and prompted refinements in trial design and additional regulatory dialogue, subsequent data reinforced the drug’s potential. Across these studies, fasedienol also displayed a favorable safety and tolerability profile, with no evidence of systemic exposure or risk of dependence.

Currently, there is no FDA-approved acute treatment for SAD, and VistaGen is confident that the PALISADE-3 and -4 trials, if successful, can support New Drug Application submissions to the FDA to have fasedienol approved as the first such treatment.

Beyond fasedienol, VistaGen is expanding its pipeline with itruvone, an intranasal candidate in development for major depressive disorder. Positive results have already been observed in an exploratory Phase 2a study, and the company plans to conduct additional Phase 2 studies to further evaluate efficacy and dosing.

Rounding out the pipeline, VistaGen is pursuing further development of its drug candidate PH80, which is being investigated for vasomotor symptoms of menopause, or menopausal hot flashes. The company has released positive results from the exploratory Phase 2a stage and is preparing an Investigational New Drug Application (IND) in advance of additional Phase 2 studies. Approximately 60% to 80% of all menopausal women in the US have experienced hot flashes.

With this diversified pipeline advancing across CNS conditions, VistaGen has caught the attention of Stifel’s Paul Matteis. The analyst notes that the company’s leading trial program, PALISADE, has had its difficulties in the past – but adds that he is confident in its chance of success.

“The two ph3s in SAD (PAL-3 & 4) remain active and continue to advance with topline readouts still on track for 4Q25 and 1H26, respectively… We continue to think VTGN has a credible chance at success given (1) prior PAL-1 failure was likely confounded by COVID, and (2) modifications to the trial design for PAL-3/4, including more stringent patient selection/conduct oversight, further increase their chances of replicating their prior successful PAL-2 outcome. While VTGN is making progress on their earlier pipeline (menopausal vasomotor symptoms and MDD), the focus remains on the upcoming binary SAD readouts, which we view as upside-biased for the stock,” Matteis opined.

These comments support Matteis’ Buy rating on VTGN stock, and his $12 price target suggests that these shares will gain ~205% in the coming year. (To watch Matteis’ track record, click here)

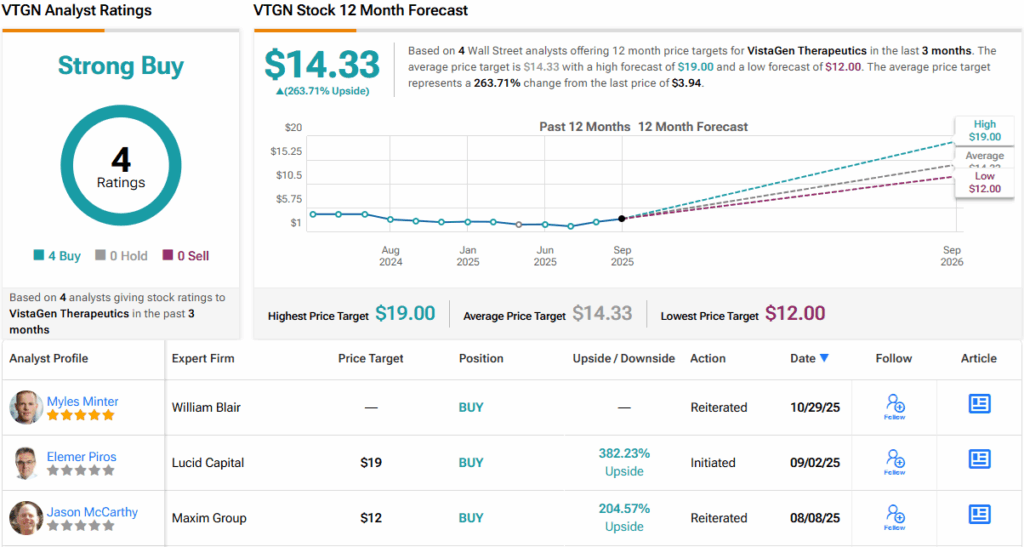

Overall, there are 4 recent analyst reviews on file for VistaGen, and they are unanimously positive, supporting the Strong Buy consensus rating. The stock is currently trading at $3.94, and its average price target of $14.33 implies a one-year upside potential of ~264%. (See VTGN stock forecast)

To find good ideas for penny stocks stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.