In the electric vehicle market, every advantage is worth keeping. So when any one advantage is lost, it tends to hurt more pointedly than normal. XPeng (NASDAQ:XPEV) learned as much the hard way when it lost a little advantage on the analyst front. It was enough to send XPeng down quite a bit in Friday afternoon’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Baird analyst Eunice Lee noted that XPeng would likely face a lot of competition going forward. Between the ongoing pricing war, and a slump in overall volume, margins would likely suffer. Worse, what XPeng has already done—its cost reduction and reorganization efforts—aren’t likely to have much impact any time soon. In fact, Lee doesn’t look for bottom-line benefits for XPeng until either late 2023 or sometime in 2024.

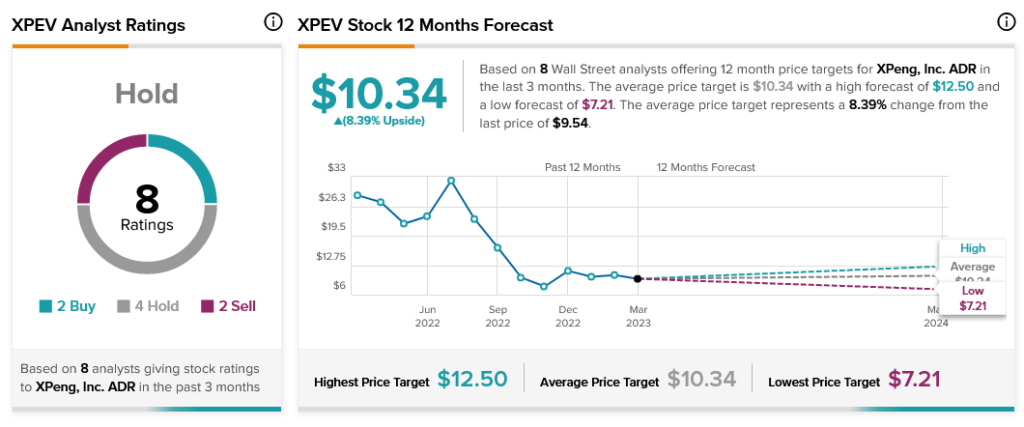

That was enough for Lee to lower ratings from “outperform” to “market perform.” Yet, it doesn’t seem Lee is alone here. Analysts are already pitching estimates lower, looking for slightly greater losses than expected as well as lower revenue. In addition, price targets on Xpeng stock are also declining, which is generally the wrong direction to go. However, others note that there isn’t a sufficiently broad range of estimates to suggest that anything disastrous will follow.

In fact, the broader pool of analysts are only somewhat cautious. Right now, XPeng stock is considered a Hold by the analyst consensus, with two Buys and two Sells bookending four Holds. Further, thanks to XPeng’s average price target of $10.34 per share, it comes with 8.39% upside potential.