As the U.S. travel industry remains mostly shutdown, one industry remains set to be hit the hardest. While airlines continue to fly drastically reduced schedules, the cruise lines are shutdown with major questions on future demand.

As the coronavirus swept through parts of Asia, the Diamond Princess cruise ship was hit with tons of cases and numerous deaths. The way passengers were quarantined on the ship and subsequent events should really question the legitimate demand for cruising in the near-term. Long-term, passengers have always come back from other virus outbreaks and initial signs for 2021 demand are already positive.

Even worse, the cruise lines weren’t considered essential by the U.S. government and failed to obtain financial aid. The best way to value these cruise lines stocks is based on liquidity to survive a weak 2020 with positioning towards a stronger time in 2021.

Unlike the airlines that have maintained operations and kept employees, the cruise lines have cut expenses to only ongoing ship operating expenses, administrative operating expenses and interest expenses. This industry doesn’t have the billion-dollar monthly losses such as the airlines reducing the dire outcomes in the short term.

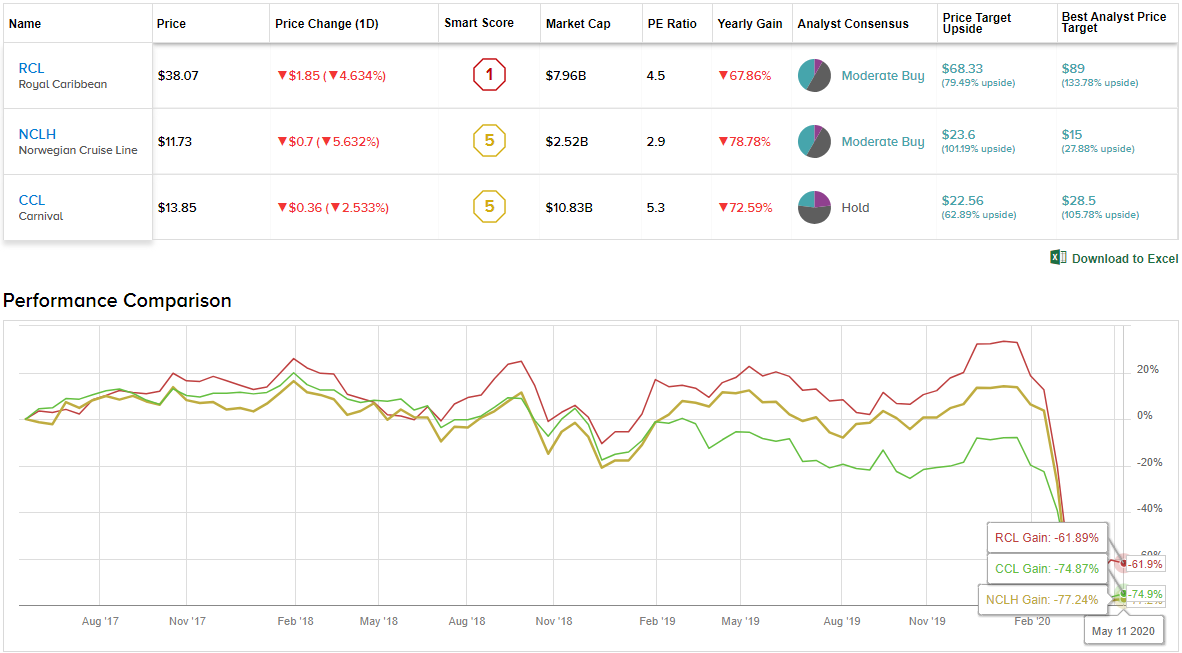

With this in mind, we’ve delved into these cruise line stocks with two stocks to consider here and one to avoid. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to get the lowdown on what the near-term holds for these cruise line players.

Royal Caribbean Cruises (RCL)

Unlike the airline industry, Royal Caribbean Cruises has halted services. The cruise line has extended a global shutdown of their 61 ships on global brands including Royal Caribbean, Celebrity Cruises, Azamara and Silversea Cruises through June 11.

The company entered the year with a 2025 program for generating $20 in adjusted EPS. Royal Caribbean had a plan to double 2019 earnings of $9.54 per share in six years. Hence, the stock was up at $135 on the back on those strong projections only back in early February.

The story here is survival in 2020 with a rebound forecast for 2021. Royal Caribbean has already laid off or furloughed a large portion of their 65,000-employee base, but the cruise line hasn’t provided monthly cash burn rates. The cruise line did confirm strong 2021 bookings with prices up from 2020 levels.

Royal Caribbean started 2020 with over $10 billion in net debt, but Royal Caribbean was able to pull down $2.2 billion in term loans to provide total liquidity of $3.6 billion. The cruise lines all have around 10 months of cash to survive a zero-revenue period per analysis by UBS. Royal Caribbean is the best positioned and least damaged of the major cruise lines to thrive in 2021.

Wells Fargo analyst Tim Conder reviewed RCL for Wells Fargo, and took a clearly bullish position. The analyst opined, “We believe RCL had ~$300MM of secured borrowing capacity left, but feel the company will leave some asset base cushion for potential writedowns which are reasonably likely for the industry in the current environment. Therefore, we feel any additional RCL capital raise would likely take the form of (1) limited secured bonds, and (2) convertible bonds, all potentially supplemented by private equity placement. We continue to view RCL as “best in class” and needing the least amount of capital, within an industry that admittedly will likely see an elongated recovery to preCOVID19 levels.”

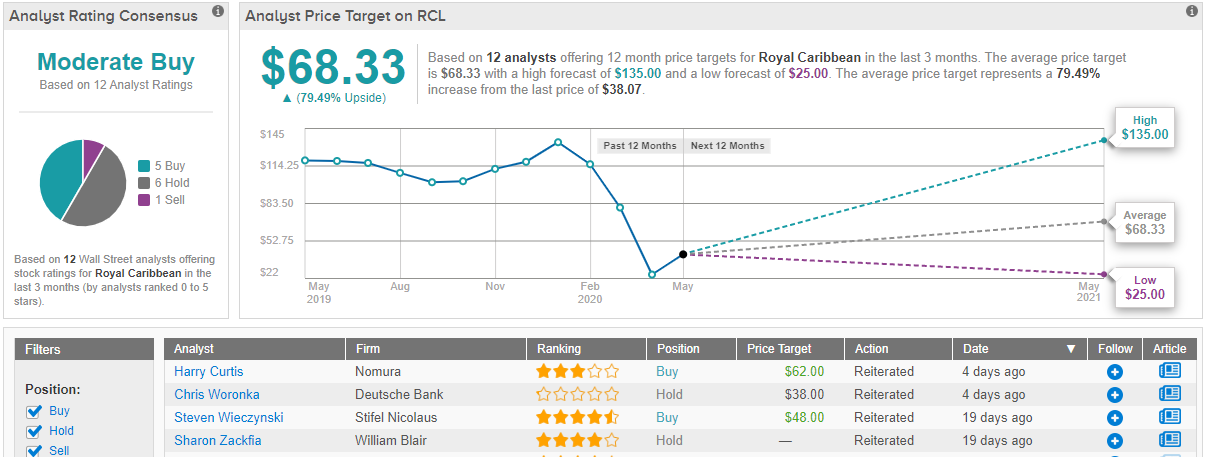

Supporting his bullish stance on RCL, Conder rates Royal Caribbean shares an Overweight (i.e. Buy). (To watch Conder’s track record, click here)

Overall, Wall Street is not convinced just yet on this cruise giant, but cautious optimism is circling, as TipRanks analytics demonstrate RCL as a Buy. Based on 12 analysts tracked in the last 3 months, 6 rate Royal Caribbean a Buy, 6 say Hold and only 1 suggests Sell. The 12-month average price target stands tall at $68.33, marking a 79% upside from where the stock is currently trading. (See Royal Caribbean stock analysis on TipRanks)

Norwegian Cruise Line (NCLH)

The smallest of the major cruise lines, Norwegian Cruise Line Holdings has seen their stock fall over $45 from the highs to below $12 now due to bankruptcy fears that popped up this week. The company operates the Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises with travel suspended through June 30.

The company quickly took down $1.55 billion from credit facilities in early March to provide liquidity during the shutdown. Like the other cruise lines, Norwegian had $8.6 billion in debt at the end of March, but the company recently raised $2.4 billion in new funds to provide plenty of liquidity to survive an extended week period for the sector.

During the suspension of operations, Norwegian is only burning cash from $110 million to $150 million per month. With operations not restarting until Q3, one should assume the company loses in the range of $400 million during the quarter with ultimate cash flows based on booking and refund levels going forward.

Even with the issuance of 41 million shares and shareholders diluted 20%, Norwegian has strong upside potential here.

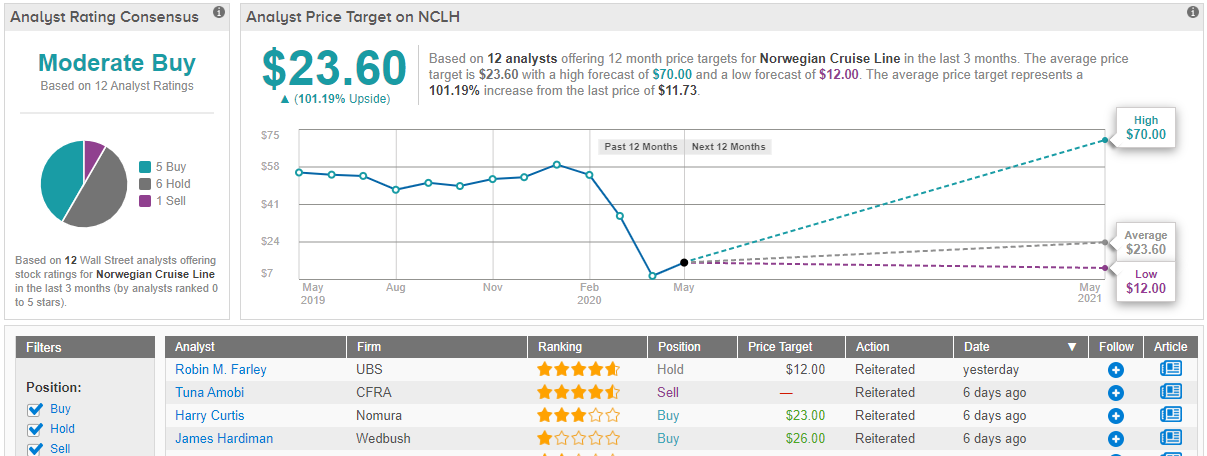

Covering NCLH for Wedbush, analyst James Hardiman writes: “While we have been relatively bearish with respect to our assumptions as to when the industry is likely to open back up much less go back to ‘normal’, the liquidity recently added by NCLH would seem to put the company in a sound position under the majority of plausible scenarios, no small feat given the gauntlet that they needed to run through in recent months to ensure the company’s survival.”

In line with this bullish stance, Hardiman gives NCLH a Buy rating. His $26 price target implies a strong upside potential here of 122%. (To watch Hardiman’s track record, click here)

Overall, Wall Street almost evenly split between the bulls and those choosing to play it safe. Based on 12 analysts tracked by TipRanks in the last 3 months, 5 rate Norwegian Cruise shares a Buy, 6 suggest Hold, while only 1 says Sell. Notably, the 12-month average price target stands at $23.60, marking a 101% potential upside from current levels. (See NCLH stock analysis on TipRanks)

Carnival Corporation (CCL)

As FY20 started, Carnival Corporation was forecasting a solid year with an EPS of $4.50. The company had plans for annual cash from operations of $5.5 billion to cover capital spending for new ships

With operations shut until August 1, Carnival faces the unfortunate uncertainty of brand damage with their Diamond Princess ship the center of the COVID-19 outbreak. The cruise ship was forced to dock in Japan for an extended period causing unknown damage to the brand.

Carnival has already outlined how FQ1 results missed expectations even with the limited COVID-19 impact through the end of February. The difficult numbers required the company to raise a substantial amount of cash while the cruise line already had net debt of $11 billion.

On April 1, Carnival raised a massive combined $6.25 billion of equity and debt funding. The company was forced to dilute shareholders at $8 per share, or nearly 50% below current prices. The equity offering of 71.88 million shares diluted existing shareholders by over 10% with 688 million shares outstanding at the end of November when the cruise line reported FY19 results.

The bond offering wasn’t much better with a $4 billion aggregate senior secured note due 2023 at 11.5% and a $1.75 billion 5.75% senior convertible notes due 2023.

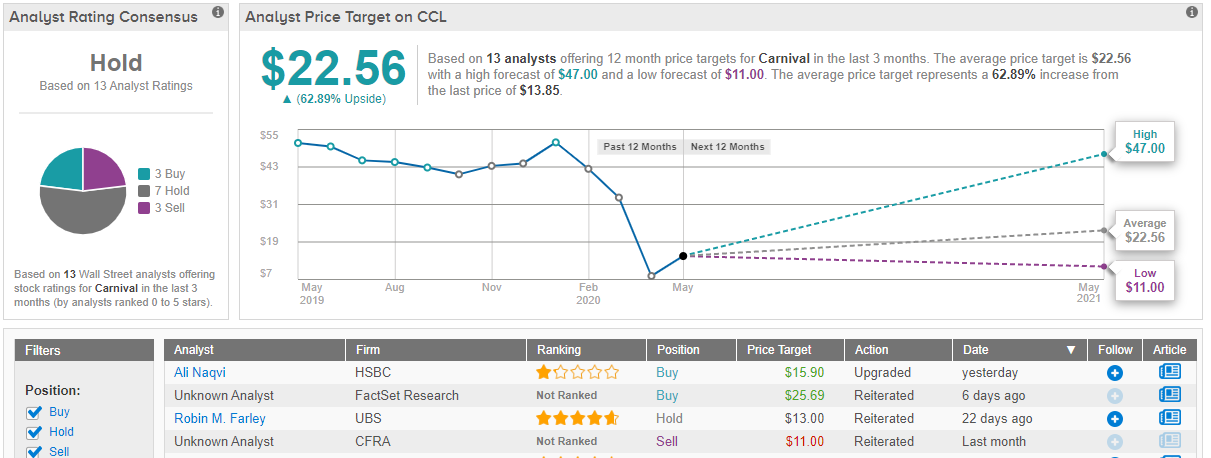

The potential damage to the brand with Diamond Princess and even Pacific Princess being part of the initial outbreaks and the massive dilution at the lows makes Carnival the least appealing of the major cruise lines on a rebound.

Carnival’s current price target implies double-digit upside, but based on all the ratings received over the past three months, Carnival is actually a Hold consensus. While 3 analysts say Buy, six recommend Hold, while 3 advise investors to abandon ship. (See NCLH stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.