American Express (AXP), a provider of charge and credit card products, delivered stellar third-quarter results driven by rapid consumer and small business spending, strong credit performance, and a steady rebound in travel and entertainment spending. Shares of the global travel-related services provider jumped 5.4% on the news, closing at $187.08 on October 22.

The company reported earnings of $2.27 per share, up 75% year-over-year, and significantly beat analyst estimates of $1.73 per share.

Additionally, revenue came in at $10.93 billion, an increase of 25% compared to the year-ago period and also outpaced Street estimates of $10.56 billion. The robust revenue growth was attributed to higher Card Member spending and an increase in average discount rates, coupled with a credit reserve release of $393 million and lower net write-offs. What’s more, Amex acquired 2.6 million new proprietary cards during the quarter.

Commenting on the results, Stephen J. Squeri, Chairman and CEO of Amex, said, “The strategic investments we’ve made over the past year, particularly those to attract new Millennial and Gen Z customers and expand our leadership position with small businesses, are helping fuel the strong momentum we’re seeing in spending, customer acquisition, engagement, and retention.”

Squeri added, “We’re operating from a position of strength, and we see more opportunity ahead to drive sustainable, long-term growth. With the progress we’ve made against our key priorities this year, we remain confident in our ability to be within the high end of the range of the EPS expectations we had for 2020 in 2022.”

In response to AXP’s quarterly performance, Bank of America Securities analyst Mihir Bhatia lifted the price target on the stock to $189 (1% upside potential) from $178 while maintaining a Hold rating.

Bhatia said that he was not surprised by the strong Q3 results and the ensuing share price jump as the results were interesting for both the Bulls and Bears. (See Insiders’ Hot Stocks on TipRanks)

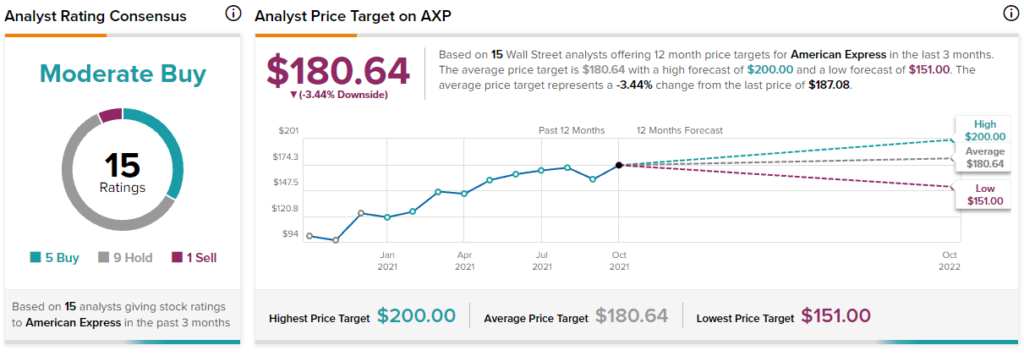

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 5 Buys, 9 Holds, and 1 Sell. The average American Express price target of $180.64 implies 3.4% downside potential to current levels. Shares have gained 93.1% over the past year.

Related News:

Snap Plunges 22% After-Hours on Disappointing Q3 Results

Intel Delivers Mixed Q3 Results & Guidance; Shares Fall 9% After-Hours

Boston Beer Delivers Mixed Q3 Results; Shares Slip 3.3% After-Hours