American Express has invested an undisclosed amount in crypto-trading platform, FalconX.

Trading as principal, FalconX provides institutional clients with access to cryptocurrency markets through a single platform for trading, credit, and clearing.

American Express (AXP) has joined a variety of investors, adding to the $17 million in funding that FalconX announced in May. Since then, FalconX has seen its revenue grow 350%, while its transaction volumes have tripled to around $3 billion per month, making it one of the largest full-service providers.

Meanwhile, FalconX Credit, which enables clients to extend settlement, has generated over $1 billion in credit transactions during November 2020.

“We’re seeing growing interest from traditional asset managers who are adding cryptocurrencies as an inflationary hedge, catalyzed by recent macro-economic policies,” said Falcon CEO Raghu Yarlagadda. “It is a great pleasure to welcome American Express Ventures as we continue to invest in expanding FalconX’s product offering.”

This is not the first time that American Express has shown interest in the blockchain/crypto space. According to a Bloomberg report, “Amex Ventures remains an investor in Abra, which allows for trading of cryptocurrencies. AmEx has also tested using blockchain to let merchants create tailored offers involving membership rewards points, and enabling international business-to-business payments.” (See AXP stock analysis on TipRanks)

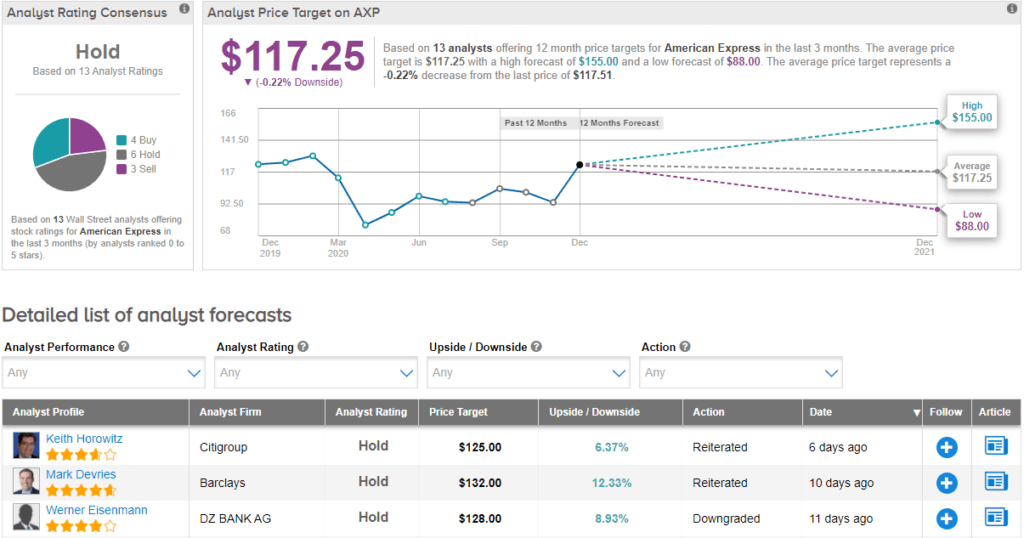

Last week, Citigroup analyst Keith Horowitz reiterated a Hold rating on the stock and raised his price target from $105 to $125. The new PT implies upside potential of around 6%.

Overall, the consensus among analysts is a Hold based on 4 Buys, 6 Holds and 3 Sells. The average price target of $117.25 suggests that shares are fully priced at current levels.

Related News:

Citigroup To Resume Dividend, Share Buyback Plans in 1Q; Shares Climb 5%

Morgan Stanley To Kick Off $10B Share Buyback After Fed Call; Shares Jump 5%

BNY Mellon To Resume Stock Buybacks; Shares Rise 5%