American Eagle Outfitters (AEO) hiked its quarterly dividend by 31% to $0.18 per share. The company is an American lifestyle, clothing, and accessories retailer.

Following the announcement, shares of the company increased 1.7% in Thursday’s extended trading session.

The dividend is payable on July 23 to shareholders of record on July 9. American Eagle’s annual dividend of $0.72 per share now reflects a dividend yield of 2.2%.

American Eagle CEO Jay Schottenstein said, “I am pleased to announce a material increase to our dividend today. Following a record first quarter result, the increase reflects our confidence in the growth potential of our leading brands and profit flow through fueled by our Real Power. Real Growth. value creation plan.”

Schottenstein further added, “We are well-positioned to sustain solid cash flow and remain committed to generating strong shareholder returns.”

On May 26, American Eagle reported stronger-than-expected Q1 results. Earnings came in at $0.48 per share and exceeded the Street’s estimates of $0.46. Total revenues of $1.03 billion were above the consensus estimate of $1.02 billion. (See American Eagle stock analysis on TipRanks)

On May 27, Jefferies analyst Janie Stichter increased the stock’s price target to $42.00 from $39.00 for 25.8% upside potential and reiterated a Buy rating.

Stichter commented, “While there are sector wide tailwinds at play, we continue to believe AEO is benefiting from its own self-help initiatives that should have permanent benefits to earnings power. Aerie remains a growth vehicle, with rapidly improving margins boosting AEO’s overall margin profile.”

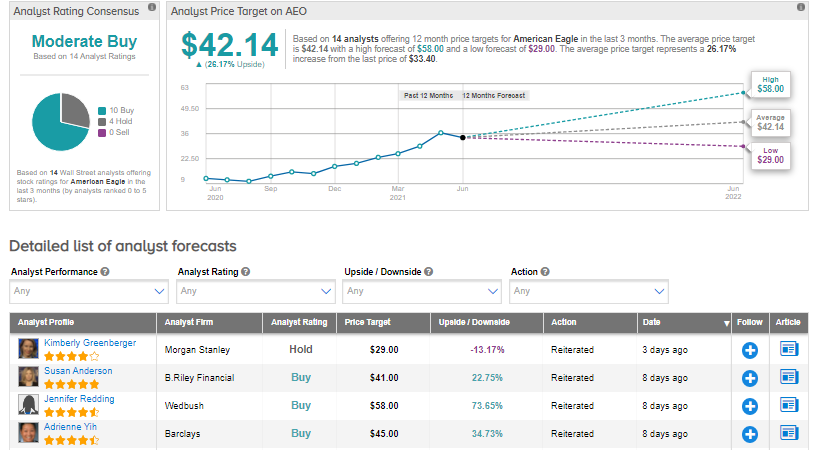

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 10 Buys versus 4 Holds. The average analyst price target of $42.14 implies almost 26.2% upside potential to current levels. Shares have increased 74.4% over the past six months.

Related News :

Splunk Posts Wider-than-Feared Quarterly Loss, Revenues Beat Estimates

PVH Corp Posts Stronger-than-Expected Quarterly Results

Advance Auto Parts Delivers Strong Q1 Results as Profit Soars