Shares of American Airlines Group Inc. (AAL) rose 2.2% on the news that the carrier’s fourth-quarter revenue would be better than expected. The carrier revised its Q4 guidance amid the Omicron scare, which forced airiness to cancel flights. Shares closed up 1.2% at $19.02 on January 11.

Revised Q4 Guidance

In an investor update released yesterday, the airlines said it flew about 61.1 billion total available seat miles (ASM) in Q4, down 13% year-over-year.

American Airlines said it expects its revenue to fall lower by only 17% compared to the Q4 2019 levels, against the prior guidance of a 20% fall. This translates to a revenue figure of roughly $9.42 billion.

Additionally, the company noted that its Q4 cost per available mile seat (CASM), which indicates the efficiency of the airline, will be up between 13% to 14% compared to the 2019 levels, and against the prior expectation of 8% to 10%.

The increase in CASM is driven by lower capacity, higher costs related to the holiday incentive program, and a write down of excess spare parts inventory.

Several airlines had canceled thousands of flights between Christmas Eve and New Year’s and well into January. These flights were canceled due to heavy snowfall in certain parts of the country, and crew and workers falling prey to the Omicron variant. Several workers were in isolation, forcing the airlines to cancel flights due to labor shortages.

Analysts’ View

Responding to the news yesterday, Morgan Stanley analyst Ravi Shanker upgraded the stock to a Hold rating from Sell and maintained the price target of $21, which implies 10.4% upside potential to current levels.

Overall, the stock has a Hold consensus rating based on 1 Buy, 4 Holds, and 2 Sells. The average American Airlines price target of $18.36 implies 3.5% downside potential to current levels.

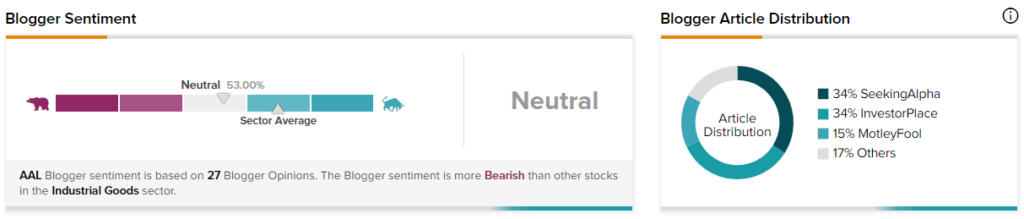

Blogger Opinions

TipRanks data shows that financial blogger opinions are 53% Neutral on AAL, compared to an airline companies sector average of 70%.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Download the TipRanks mobile app now

Related News:

JD.com Opens Robotic Stores in Europe; Shares Rise

Apple Provides Services Segment Update

fuboTV Releases Preliminary Q4 Results; Shares Down 8.4%