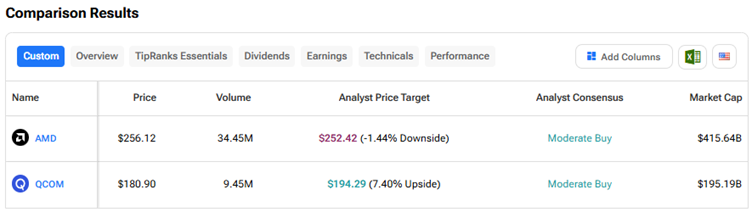

Chip stocks are in focus, thanks to the massive demand created by the artificial intelligence (AI) boom. While Nvidia (NVDA) remains the dominant player in the AI chip market, competition from other chip companies, such as Advanced Micro Devices (AMD) and Broadcom (AVGO), is rising. All eyes are now on the upcoming earnings reports from AMD and Qualcomm (QCOM), with investors awaiting more details on their AI roadmaps. Using TipRanks’ Stock Comparison Tool, we placed AMD and Qualcomm against each other to find the best chip stock, according to Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Advanced Micro Devices (NASDAQ:AMD) Stock

Advanced Micro Devices stock has rallied 58.3% over the past month and is up 112% year-to-date. This rally has been driven by optimism about the company’s new AI GPUs (graphics processing units) and the announcement of a game-changing deal with OpenAI (PC:OPAIQ) to deploy six gigawatts of AI capacity. The chipmaker’s stock also gained from the announcement of a deal with Oracle’s (ORCL) OCI (Oracle Cloud Infrastructure) for the deployment of 50,000 AI chips.

AMD is scheduled to announce its Q3 results after the market closes on November 4. Wall Street expects AMD to report Q3 EPS (earnings per share) of $1.17, reflecting a 27.2% year-over-year growth. Revenue is projected to increase by more than 28% to $8.76 billion.

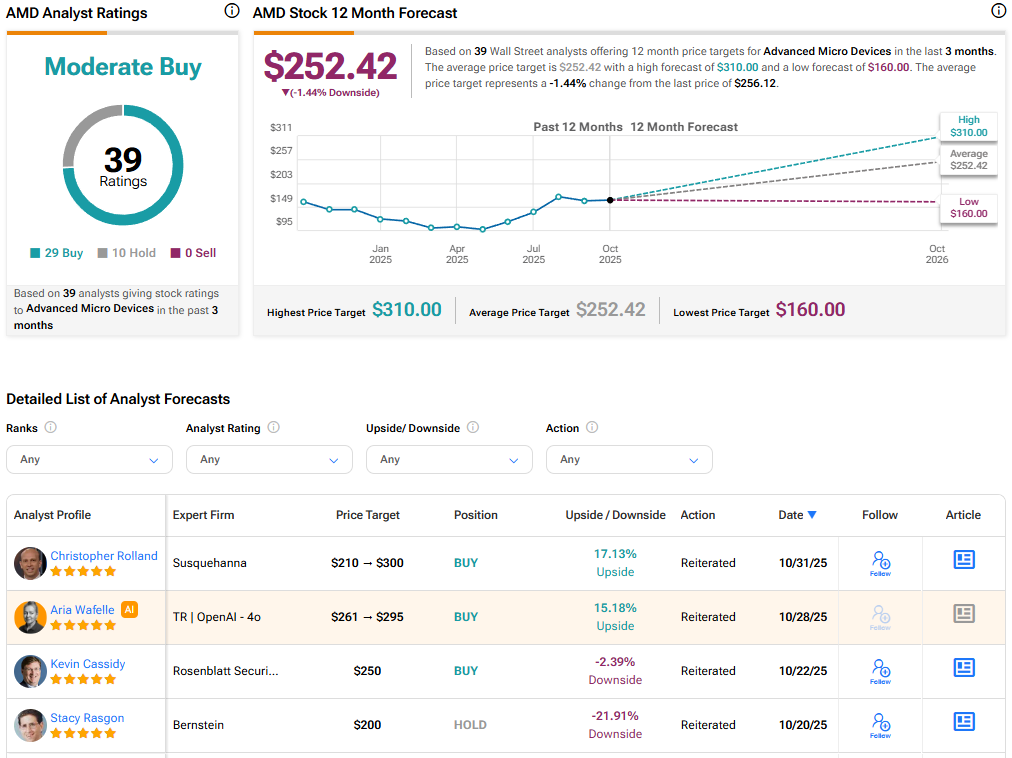

Is AMD Stock a Buy or Sell?

Ahead of the Q3 results, UBS analyst Timothy Arcuri reiterated a Buy rating on Advanced Micro Devices stock with a price target of $265. “Much like INTC, we see an upside bias for FQ3 with results likely skewed toward the $9B high-end of guidance,” said Arcuri. The 5-star analyst expects AMD to benefit from strength in both server and client CPU businesses, with server strength potentially driving some upside in gross margin. Arcuri expects Q3 data center GPU revenue of about $1.7 billion. He expects Q3 revenue of $8.94 billion and adjusted EPS of $1.26.

For Q4, the analyst remains “comfortable” with his revenue estimate of about $9.3 billion. That said, Arcuri sees the possibility of AMD guiding Q4 revenue as high as $9.5 billion, driven by renewed server upgrade activity and some “spillover” from AI into traditional compute infrastructure. Meanwhile, he expects AMD’s client business to be flat to up, “better than normal seasonal.” He expects Q4 data center GPU revenue of about $2.4 billion, up $700 million compared to the third quarter, driven by the ramp of MI355x, with demand from Meta Platforms (META) and Oracle’s (ORCL) OCI (Oracle Cloud Infrastructure), and more customers.

While AMD’s Q1 2026 outlook could be impacted by normal seasonality, Arcuri expects the company to issue a “very bullish” multi-year outlook for its data center GPU business.

Overall, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 29 Buys and 10 Holds. The average AMD stock price target of $252.42 indicates a possible downside of 1.4% from current levels.

Qualcomm (NASDAQ:QCOM) Stock

Chipmaker Qualcomm is scheduled to announce its results for the fourth quarter of Fiscal 2025 on November 5. Qualcomm stock has risen about 18% year-to-date. The stock soared recently when the company announced its plans to launch two new AI chips, the AI200 and AI250, in 2026 and 2027, respectively, for use in data centers. Qualcomm also announced a partnership with Saudi Arabia–backed AI firm Humain to deploy 200 megawatts of its accelerator cards to support the country’s AI ambitions.

These announcements cheered investors about Qualcomm’s efforts to capture the opportunities in the AI chip market. Qualcomm, which has long been dependent on the smartphone market, is aggressively expanding into other areas like automotive and IoT (Internet-of-Things). The launch of the new AI chips will help boost QCOM’s business amid a rapid growth in data centers.

Meanwhile, Wall Street expects Qualcomm to report adjusted EPS of $2.87, reflecting a 6.7% growth from the prior-year quarter. Revenue is expected to rise 5% year over year to $10.75 billion.

Is QCOM Stock a Good Buy Now?

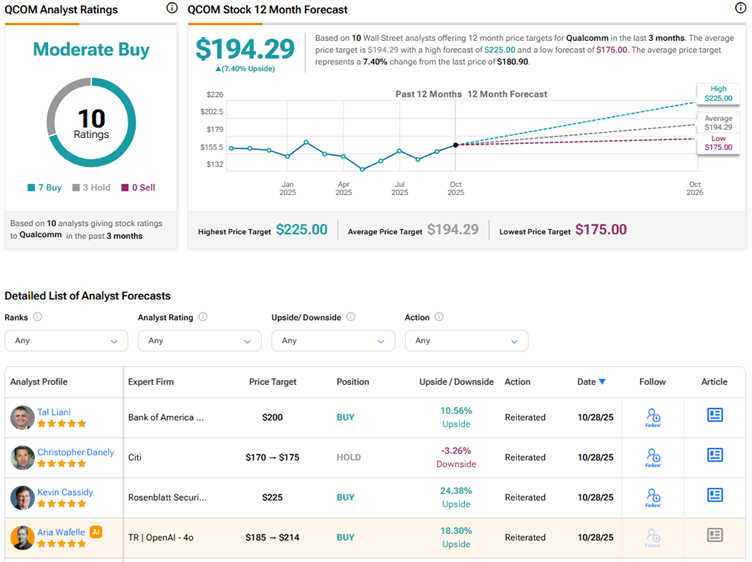

Following the announcement of the AI chips, Bank of America analyst Tal Liani reiterated a Buy rating on Qualcomm stock with a price target of $200. The 5-star analyst stated that the move marked a “needed diversification” away from the low-growth smartphone market, which accounts for about 75% of the Qualcomm CDMA Technologies (QCT) segment’s revenue. Liani added that the new AI chips will address a market that Bank of America expects to grow to about $114 billion by 2030, with key customers looking for vendors beyond Nvidia. However, Liani cautioned that the 2026 opportunity related to the new AI chip is limited to a single deal, and technical execution needs to be demonstrated by the company.

Meanwhile, Liani noted that QCOM stock’s underperformance compared to peers is due to the expected decline in revenue resulting from Apple’s (AAPL) shift to in-house modem chips, risk of losing parts of Samsung’s (SSNLF) business, and exposure to the smartphone market that is “secularly stagnant.” That said, Liani believes that QCOM stock’s low valuation makes it attractive, given the potential for expansion in the total addressable market and share gains.

Currently, Wall Street has a Moderate Buy consensus rating on Qualcomm stock based on seven Buys and three Holds. At $194.29, the average QCOM stock price target indicates 7.4% upside potential.

Conclusion

Wall Street is currently cautiously optimistic on Advanced Micro Devices and Qualcomm stocks. However, given the impressive year-to-date rally in AMD stock, some analysts think that the optimism about demand for the chipmaker’s AI chips is already priced in. Meanwhile, analysts see upside potential in QCOM stock, especially following the recent announcement about its upcoming AI chips. AMD and QCOM’s upcoming earnings and updates on their AI opportunities could act as catalysts for these stocks.