Movie theater chain AMC Entertainment (NYSE:AMC) has not had an easy run of things for the last three years or so. With forced closures, a slow and uneven recovery, the rise of streaming video, and then a writer’s and actor’s strike, the end result is pretty much nothing but trouble. And despite this weekend’s phenomenal win, AMC was still down modestly in Monday afternoon’s trading. This weekend featured a development that many saw coming, but no one was exactly sure just what kind of impact it would have: the release of “Taylor Swift: The Eras Tour,” a concert video that basically taped a concert and showed it in AMC theaters.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Swifties of all stripes, including those who didn’t get a chance to see the show live and those who wanted to see it again by any means available, flocked to theaters and brought in a whopping $92.8 million for a domestic opening weekend. That was about 70% of what United States theaters made that entire weekend. It’s also the second-best domestic opening weekend ever for October; only Joachim Phoenix’s “Joker” could top it with $96.2 million.

In fact, some are beginning to wonder if this marks the start of a whole new era of distribution, in which filmmakers make a film and then take it directly to the theaters themselves. Given that studios commonly land between 80% and 100% of a movie’s ticket sales for the first two to three weeks, reports note, there’s a clear profit motive for theaters to handle their own distribution. Theaters typically rely on concession sales to make up the difference, but that’s uncertain money at best. Taylor’s phenomenal concert video may have started something much, much bigger.

Is AMC a Buy, Sell, or Hold?

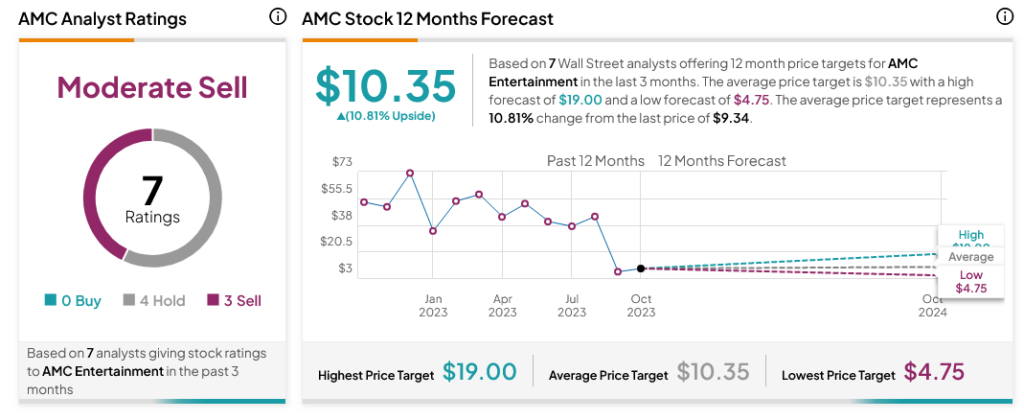

Turning to Wall Street, analysts have a Moderate Sell consensus rating on AMC stock based on four Holds and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMC price target of $10.35 per share implies 10.81% upside potential.