Global e-commerce giant Amazon.com (NASDAQ:AMZN) is once again being scrutinized for anti-competitive behavior with its planned $1.7 billion purchase of iRobot (NASDAQ:IRBT). The European Commission is opening a full-fledged investigation into the buyout, citing concerns of a monopolistic nature and further strengthening Amazon’s position as an online marketplace. The commission will decide the fate of the deal by November 15, 2023. IRBT stock has gained 12.1% in the past year following the acquisition announcement.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Regulator’s Concerns Cast Doubt on Pending Deal

Amazon has its eyes set on iRobot’s smart vacuum cleaner, Roomba, which is one of the few competitive products in a market crowded with Chinese offerings. The EU worries that Amazon can leverage its marketplace power to direct users’ searches to Roomba, proving a disadvantage to other players who market similar products on the e-portal.

Moreover, Amazon will get access to iRobot’s consumer data, which has been a concern for regulators worldwide, as big data companies can use such data to their advantage. Should the EU be successful in proving its concerns true, the European watchdog will block the deal.

Amazon announced the iRobot acquisition in August 2022 and is awaiting regulatory approval from several nations. In June 2023, the U.K. regulator, the Competition and Markets Authority (CMA), gave its unconditional nod to the deal. On the other hand, a report by Politico in March 2023 claimed that the U.S. Federal Trade Commission (FTC) was mulling over whether to challenge Amazon’s iRobot deal. The FTC is worried that Amazon may indulge in “deceptive advertising” under the “Amazon Choice” label for the robotic vacuum cleaner product category.

Is AMZN a Buy Right Now?

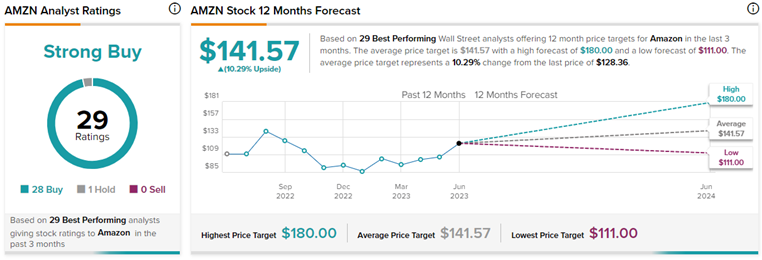

Despite several lawsuits and competition in the tech space, Wall Street remains highly optimistic about AMZN stock. On TipRanks, out of the top 29 analysts who recently rated AMZN, 28 have given it a Buy while only one has given it a Hold rating.

Top Wall Street analysts are those awarded higher stars by TipRanks Star Ranking System. This is based on an analyst’s success rate, average return per rating, and statistical significance (number of ratings). Based on these views, Amazon commands a Strong Buy consensus rating. Also, the average Amazon.com price forecast of $141.57 implies 10.3% upside potential from current levels. Meanwhile, year-to-date, AMZN stock is up 49.6%.