Amazon’s (AMZN) Relentless game studio has announced that it is moving its Crucible game back to closed beta following a critical reception from players.

Crucible is a free-to-play multiplayer third-person shooter, and is Amazon’s first major original title published by their gaming division, which had previously focused on tablet games.

The company says it will continue working on map, combat, and system changes to improve the Heart of the Hives experience as well as implementing other improvements based on player feedback.

Moving forward, there will also be scheduled dedicated time each week for the developers to play with the ‘community’ and solicit feedback- although the game will still be accessible 24/7.

And there will be a new community council, made up of beta participants of all playstyles, who the Crucible team says it will be working especially closely with. The goal: to provide the best possible experience for players.

Indeed, on June 4, Crucible franchise lead Colin Johanson revealed that the game would stay in pre-season mode as “there are features that we need to add as a top priority, like voice chat.” He also announced that the company would focus on one game mode instead of three, and remove Harvester Command and Alpha Hunters for the foreseeable future.

“Right now our plans for improvements… include custom tailoring the map for Heart of the Hives, improving the creatures in the world, adding support for custom games, and enhanced social system functionality” Johanson wrote.

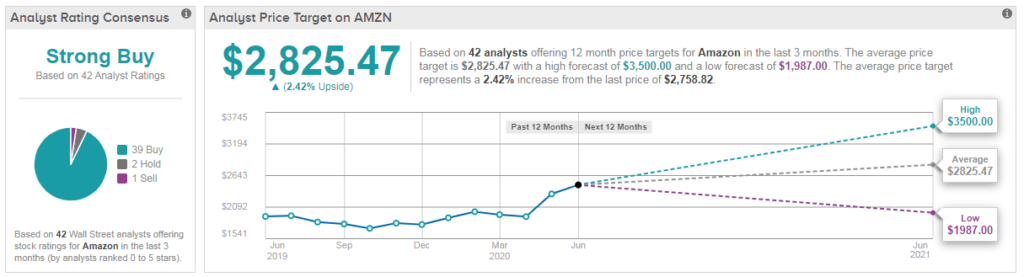

Shares in Amazon have exploded by 49% year-to-date, and analysts have a bullish Strong Buy consensus on the stock’s outlook. That’s with 39 buy ratings in the last three months, versus 2 holds and just 1 sell. However, due to the recent rally the average analyst price target suggests just 2% upside potential from current levels. (See Amazon’s stock analysis on TipRanks).

Five-star Monness analyst Brian White has just ramped up his price target from $2,800 to $3,500 (27% upside potential), arguing that AMZN will be a key beneficiary from the digital transformation aftermath of Covid-19.

He explains: “In this new reality, we believe Amazon holds the key capabilities, vast global infrastructure and financial strength necessary to support the needs of people and organizations around the world, while also positioning the company as a major beneficiary of accelerated digital transformation that we expect will be ushered in with the aftermath of this pandemic, driving greater use of ecommerce, the cloud and emerging tech.”

Related News:

Amazon Acquires Self-Driving Startup Zoox

Lookout Walmart, Amazon Is Coming for Your Grocery Customers, Says Analyst

Slack Seeks To Replace E-mail With Launch Of Virtual Business Platform