E-commerce major Amazon (NASDAQ:AMZN) has agreed to purchase 250,000 metric tons of carbon dioxide removal (CDR) credits from 1PointFive, a subsidiary of Occidental Petroleum (NYSE:OXY), over a period of 10 years. 1PointFive is engaged in carbon capture, utilization, and sequestration.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Importantly, the agreement further bolsters the case for direct air capture as a viable solution for carbon removal. The credits will be from 1PointFive’s first commercial-scale plant, STRATOS, in Texas. The under-construction plant is designed to capture up to 500,000 metric tons of carbon dioxide annually. The agreement is part of Amazon’s aim to decarbonize its operations and reach net-zero carbon emissions by 2040.

In another development, Amazon has announced a completely automated set of supply chain services called Supply Chain by Amazon to help sellers efficiently move products from their manufacturers to customers globally.

The solution will mean hassle-free shipping and delivery of products for sellers. This, in turn, will help sellers focus their efforts on product development and driving business growth.

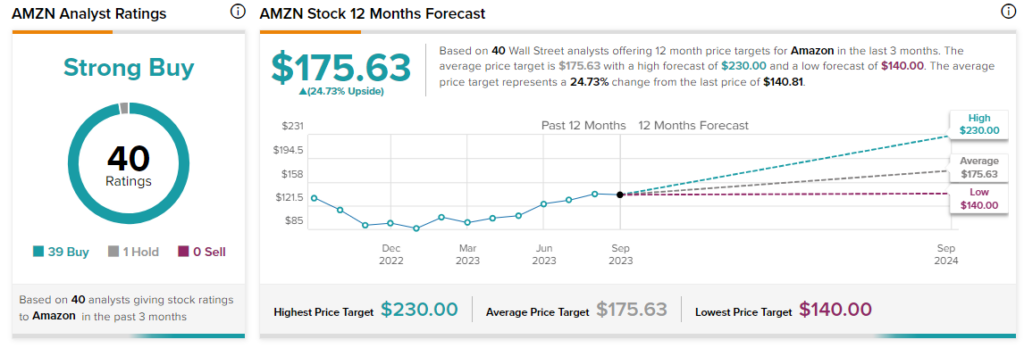

Today, Barclays analyst Ross Sandler has reiterated a Buy rating on Amazon while assigning a $180 price target. Overall, the Street has a consensus price target of $175.63 on the stock, accompanied by a Strong Buy consensus rating.

Read full Disclosure