Technology giant Amazon.com (NASDAQ:AMZN) is unhappy with rating agency Nielson’s decision to exclude Amazon’s viewership data when evaluating “Thursday Night Football.” Both Amazon and the National Football League (NFL) had made efforts to get Nielson to incorporate first-party data when determining advertising ratings. According to reports, Nielson stated that the procedure is underway and will take some time.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Here’s Why Nielson Has Put the Decision on Hold

The independent body, the Media Rating Council (MRC), which is in charge of setting measurement standards, has not yet approved the inclusion of first-party data with Nielson’s data for giving ratings. According to Amazon, Nielsen’s viewership data for last year’s Thursday Night Football significantly lagged behind Amazon’s own data. Consequently, Amazon believed it would be beneficial to incorporate both datasets.

Even though Nielson has shown excitement about including first-party data in its ratings, the firm needs to await proper approval. “We remain committed to adhering to the MRC’s measurement standards,” Nielson noted yesterday.

Meanwhile, other streaming networks, namely Disney’s ESPN (NYSE:DIS), Paramount Global (NASDAQ:PARA), and Fox (NASDAQ:FOXA), have contested Nielson’s decision to include Amazon’s data. The peers worry that Amazon’s data lacks authentication, which is why it has not yet been incorporated into the ratings.

For now, the inclusion of Amazon’s data remains on hold, but the change could soon take effect once the MRC approves it.

Is AMZN a Buy Right Now?

2023 seems to be a good year for tech stocks. The artificial intelligence (AI)-led frenzy had lifted investor sentiment towards tech stocks. Year-to-date, AMZN stock is up 60.6%.

Amazon maintains a Strong Buy consensus rating on TipRanks. This is based on 39 Buys and one Hold rating in the last three months. The average Amazon.com price target of $175.63 implies 27.4% upside potential from current levels.

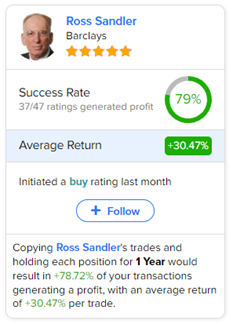

Moreover, investors looking for the most profitable analyst for AMZN could follow Ross Sandler of Barclays. Copying his trades on this stock and holding each position for one year could result in 79% of your transactions generating a profit, with an average return of 30.47% per trade.