Amazon.com Inc. (AMZN) is reportedly planning to offer at least $100 million in stock awards to retain the 900-plus employees of Zoox, the self-driving car startup it agreed to buy last month.

The technology has an option to nix the $1.3 billion deal should large numbers of Zoox employees decide to turn down the job offer, according to a Reuters report.

Amazon, which has been seeking to expand the automation capabilities of its e-commerce business, announced June 26 that it had agreed to acquire the Silicon Valley company, which was originally founded to design a fully autonomous vehicle from scratch rather than retrofitting existing cars for self-driving.

The Amazon-Zoox deal documents seen by Reuters describe two lists of “key employees.” All on the first list must take Amazon jobs for the deal to close, and at least 19 from the second list must stay. Amazon plans to offer jobs to three schedules of other Zoox employees, requiring that 90% of the first two and 88% of the third accept jobs to close the deal. The two parties expect the transaction to be closed by September.

The rewards for current Zoox employees who stay on – even those who joined recently – far outstrip those of long-time former employees with only common shares or those employees who leave before the close. Common shares are expected to be valued between 69 cents and 76 cents each after the deal closes, according to the documents.

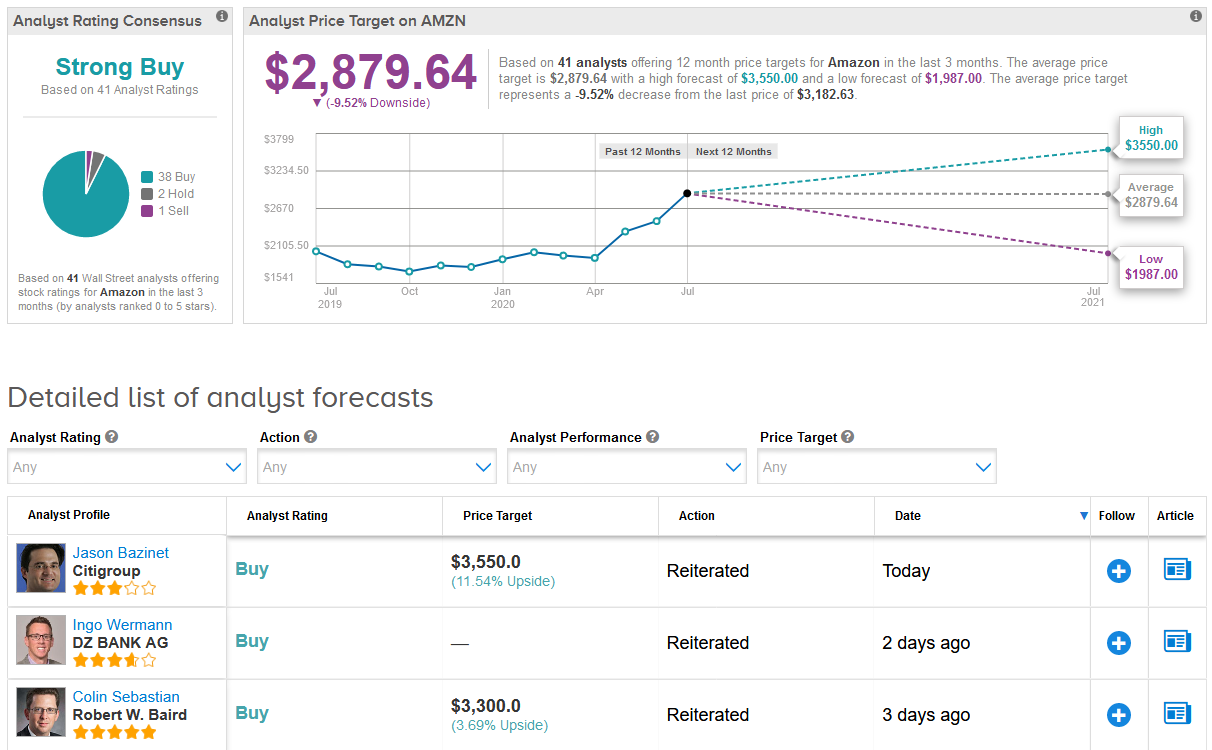

Shares in Amazon have been on a steady winning streak jumping 72% so far this year, prompting Baird analyst Colin Sebastian to call the tech giant the “gift that keeps giving”. The analyst this week raised the stock’s price target to $3,300 from $2,750 and reiterated a Buy rating.

“We believe Amazon has largely stabilized logistics operations, third parties are generally back on track, and the company has gained share in multiple ‘essentials’ product categories,” Sebastian wrote in a note to investors. “Moreover, investors may not yet fully embed either the margin benefits of cheaper new user acquisition or the sustainability of higher growth in the second half and beyond.”

TipRanks data shows that overall analysts are in line with Sebastian’s bullish outlook on the stock. The Strong Buy consensus boasts 38 Buys versus 2 Holds and 1 Sell. In view of this year’s rally, the $2,879.64 average analyst price target implies 9.5% downside potential in the stock in the coming 12 months. (See Amazon stock analysis on TipRanks).

Related News:

Amazon Delays Prime Day- This Time Until October

Google Snaps Up Canadian Smart Glasses Startup North

Lookout Walmart, Amazon Is Coming for Your Grocery Customers, Says Analyst