Amazon (AMZN)-backed artificial intelligence (AI) startup Anthropic has announced plans to spend $50 billion on data centers located in the U.S.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company, known for its Claude chatbot, says it plans to start by developing custom data centers in Texas and New York. The facilities will support Anthropic’s enterprise growth and its long-term research.

Additional AI data centers will follow in coming years, with the first locations going live next year (2026). Anthropic said that the data center projects will create 800 permanent jobs and more than 2,000 construction roles in the initial phases.

AI Race

Anthropic’s $50 billion investment is the latest example of how technology companies are spending heavily on AI infrastructure as they race to keep up in the space. Technology companies, policymakers, and investors are increasingly focused on compute capacity and the energy needed to power data centers that run AI applications and models.

Anthropic serves more than 300,000 businesses, with enterprise clients driving most of its revenue. The number of large accounts that generate more than $100,000 annually has increased sevenfold in the past year. The company’s largest investor is Amazon, which has plowed $8 billion into the startup as the e-commerce giant looks to expand its own AI offerings.

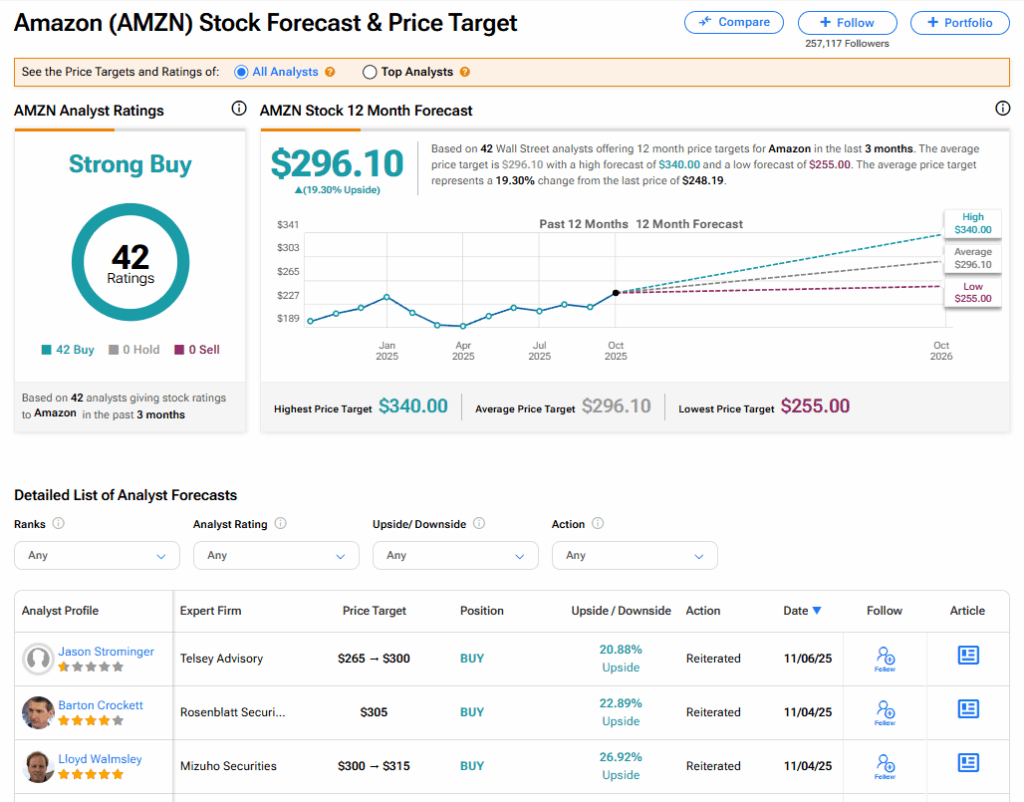

Is AMZN Stock a Buy?

AMZN stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 42 Buy recommendations assigned in the last three months. The average AMZN price target of $296.10 implies 19.30% upside from current levels.