Altria (NYSE:MO) may be one of the biggest names in the tobacco industry, but its migration to other substances seems to be coming to a halt. In fact, Altria is down slightly in Monday afternoon trading after announcing that it won’t be buying any more of Cronos Group (NASDAQ:CRON). Since Cronos Group’s focus is on cannabis research, that suggests that Altria may be looking to go a different way with any connection to pot.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Just recently, Altria lowered the boom, notifying Cronos Group that it irrevocably gave up its warrant to purchase further shares of Cronos. The move means a capital loss of $483 million, which Altria will claim on its 2022 income taxes. Altria currently owns over 156 million shares of Cronos Group, which represents a 45% ownership stake in the company. Altria’s warrant allowed it to buy as many as 240,816,760 shares, around 52% of the company.

Given how much of the company Altria currently owns, it probably wanted to stop short of a complete buyout considering CRON stock’s trading levels and the warrants’ expiration date of March 2023.

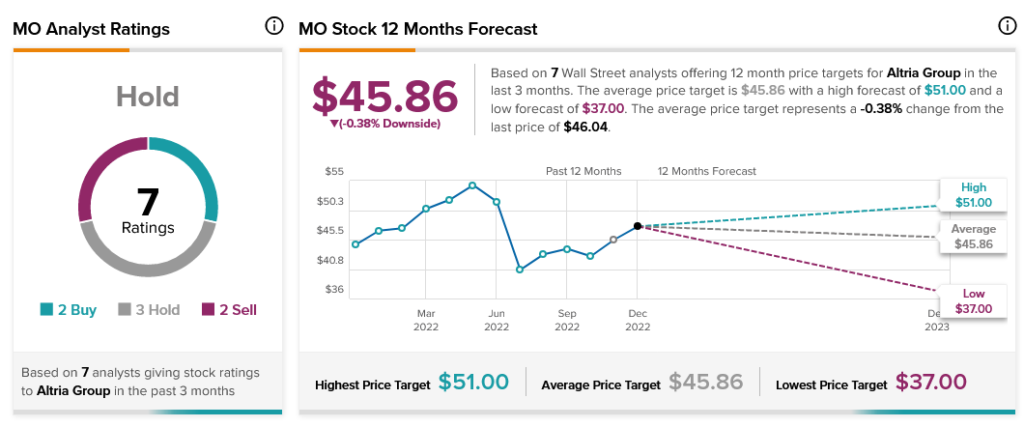

Regardless of Altria’s motives, the market is less than pleased. Currently, analyst consensus stands at Hold, with Buy, Hold, and Sell recommendations nearly equal through the pool. Moreover, Altria currently has a downside risk of 0.38%, thanks to its target price of $45.86 per share.