Shares of Alteryx jumped almost 24% in Monday’s extended market trading after the data analytics specialist improved its 3Q revenue guidance and announced the appointment of a new CEO.

Alteryx (AYX) now estimates 3Q revenue in a range of $126 million to $128 million, representing year-over-year growth of 22% to 24%. The numbers are higher than the previously provided revenue guidance of $111 million to $115 million, issued on Aug. 6. The company is scheduled to report 3Q results on Nov. 5.

In addition, the company announced that Mark Anderson, a board member of the company, will succeed Alteryx co-founder, chairman, and CEO Dean Stoecker, effective immediately. Stoecker will also serve as Alteryx’s executive chairman and the board’s chairman. (See AYX stock analysis on TipRanks).

Following the announcements, Wedbush analyst Daniel Ives reiterated his Buy rating on the stock with a price target of $132 (15.9% upside potential). Ives said that Anderson’s appointment as a CEO “should reassure AYX bulls as Anderson’s expertise and track record with scaling enterprise software organizations, most recently with Palo Alto Networks, keeps the company in good hands on its march towards $1 billion in revenue.”

The analyst remains positive on the raised 3Q guidance and added that “AYX is well positioned to capture major share in the nearly ~$50B analytics, business intelligence, and data preparation market with its code-friendly end-to-end data prep and analytics platform.”

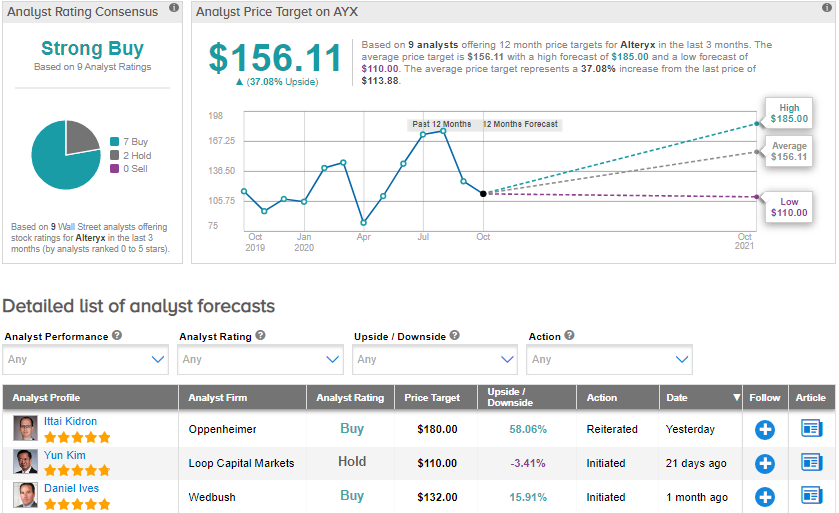

The Street has a bullish outlook on the Alteryx stock. The Strong Buy analyst consensus is based on 7 Buys and 2 Holds. The average price target of $156.11 implies upside potential of about 37.1%. Shares are up 13.8% year-to-date.

Related News:

Oppenheimer Bumps Up Starbucks PT To $101 On Sales Recovery Bet

Targa Up 6% On $500M Buyback Plan, Strong Outlook; Analyst Sees 82% Upside

Smart Global Drops 12% On 4Q Sales Miss