Alteryx shares were down about 9% on Monday after the analytic automation process company lowered its annual recurring revenue or ARR guidance for 2020. The news overshadowed the company’s improved outlook for total revenue.

The company now expects 2020 ARR between $492 million-$495 million, reflecting an increase of 32%-33% year-over-year. Alteryx (AYX) had previously predicted ARR of $500 million.

For full-year 2020, it estimates total revenue to grow 17%-18% to a range of $490 million-$493 million, up from the prior outlook of $481 million-$485 million. For 4Q, Alteryx anticipates sales to amount to $155 million-$158 million, implying a year-over-year change of -1% to 1%. According to the previous 4Q revenue guidance, the company had been aiming for a range of $146 million-$150 million. Alteryx is scheduled to announce its 4Q and full-year results on February 9.

Additionally, the company announced the appointment of Dean Darwin as its chief revenue officer (CRO), succeeding Scott Jones, who is leaving the company to pursue outside opportunities.

Darwin will lead the global go-to-market (GTM) organization, including worldwide sales, channels and all industry-specific GTM initiatives. Darwin previously served as the senior vice president and general manager at Palo Alto Networks and also held several senior executive positions at F5 Networks. (See AYX stock analysis on TipRanks)

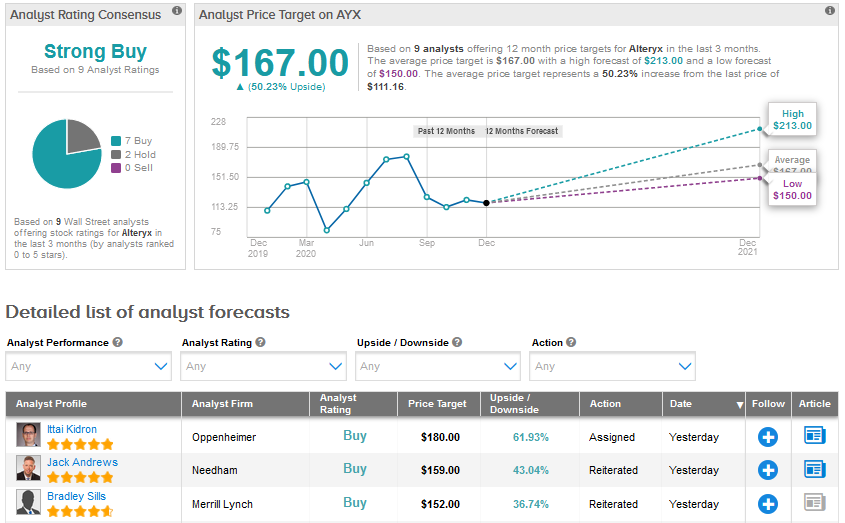

In reaction to the latest updates, Oppenheimer analyst Ittai Kidron reiterated a Buy rating with a price target of $180, and commented “We’re not surprised by the CRO transition given the timing (Alteryx starting its new fiscal year) and the opportunity for new CEO Mark Anderson (joined in Oct. 2020) to bring in his own team.”

“We believe [Darwin] has the right experience to partner with Mark and evolve Alteryx’s sales organization to a platform-based company (APA),” Kidron summed up.

Currently, Alteryx scores a Strong Buy analyst consensus based on 7 Buys versus 2 Holds. The average price target of $167 reflects upside potential of 50.2% from current levels. Shares have gained about 22% in 2020.

Related News:

T-Mobile To Buy Sprint-Branded Wireless Assets; Street Is Bullish

Roku On Cusp Of Deal To Buy Quibi’s Content Catalog – Report

ViacomCBS Inks Distribution Deal With Disney’s Hulu; Guggenheim Sticks To Buy