Alphabet Inc. (NASDAQ: GOOGL), the parent company of Google, posted another strong quarter, exceeding the Street’s expectations on both revenue and earnings fronts in the fourth quarter of 2021. Higher advertising revenue, elevated consumer online activity, and strong contribution from Google Cloud drove results.

Along with the earnings release, Alphabet disclosed that the Board of Directors had approved and declared a 20-for-one stock split, pending shareholders’ approval. The move is expected to make the stock available for mass investors.

The split will be in the form of a one-time special stock dividend on each share of the company’s Class A, Class B, and Class C stock. Post-approval, all stockholders of record as of July 1, 2022, will receive a dividend of 19 additional shares of the same class of stock for each share held, after the close of business on July 15, 2022.

Following the company’s update, shares of the company jumped 9.2% in the extended trading session on Tuesday.

Results in Detail

Earnings per share during the quarter surged 37.6% year-over-year to $30.69 and topped analysts’ expectations of $27.48 per share. Revenue grew 32% to $75.33 billion and surpassed the Street’s estimate of $72.13 billion.

Google advertising revenue jumped 32.5% year-over-year to $61.2 billion in Q4, including a 26% jump in revenues from YouTube ads, which hit 5 trillion views in the quarter. The company managed to sail through the holiday season in terms of its advertising revenue, despite the negative impacts on travel and retail categories due to the rapid spread of Omicron and supply chain challenges.

Additionally, Google Cloud reported 44.6% growth and stood at $5.54 billion, beating analysts’ estimates of $5.42 billion. It’s interesting to note that the company has made huge investments in building out the cloud-computing division to be competitive in the market and diversify revenue sources beyond its digital-ad business, which contributed over 80% of total sales.

Meanwhile, Traffic Acquisition Costs (TAC) came in at $13.4 billion, up 27.6% year-over-year. These costs relate to funds, which are paid by Google to publishers and phone makers like Apple (AAPL).

Operating margin came in at 29%, compared with 28% in the same quarter last year.

Despite regulatory issues, for 2021, Alphabet reported earnings of $112.20 per share, which almost doubled from earnings of $58.61 per share recorded in 2020. Revenues stood at $257.6 billion, up 41% year-over-year.

The company repurchased common stock worth $50 billion in 2021.

Official Comments

Encouragingly, the CEO of Google and Alphabet, Sundar Pichai, said, “Our deep investment in AI technologies continues to drive extraordinary and helpful experiences for people and businesses, across our most important products. Q4 saw ongoing strong growth in our advertising business, which helped millions of businesses thrive and find new customers, a quarterly sales record for our Pixel phones despite supply constraints, and our Cloud business continuing to grow strongly.”

However, looking forward, Alphabet SVP and CFO Ruth Porat said, “In the first quarter, based on current spot rates, we expect the foreign exchange impact on reported revenues to be a headwind.”

Porat also expects a significant rise in capital expenditures in 2022, driven by investments in servers and facilities construction.

Wall Street’s Take

Following the Alphabet earnings report, Stifel Nicolaus analyst Scott Devitt maintained a Buy rating on Alphabet and increased the price target to $3,500 (27.14% upside potential) from $3,200.

Devitt believes that the company “continues to drive growth at scale, generate impressive FCF, and return value through ongoing share repurchases.”

The analyst remains confident about the company’s long-term growth opportunities.

Shares of Alphabet have shot up almost 60% over the past year. Overall, the stock has a Strong Buy consensus rating based on 18 unanimous Buys. That’s alongside an average Alphabet price target of $3,441.47, which implies 25% upside potential to current levels.

Smart Score

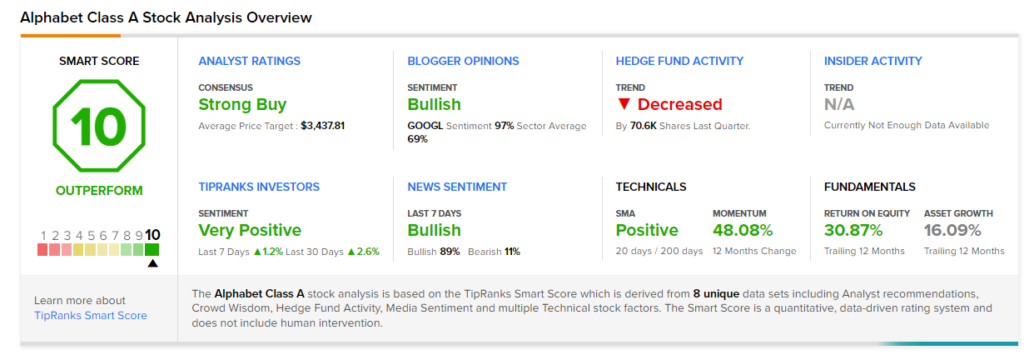

On top of this, Alphabet scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

XPeng Records Over 12,000 Deliveries this January

ExxonMobil, Targeting Reduced Costs, Restructures Business Units

Citrix Systems to go Private for $16.5B; Shares Fall