Tech behemoth Alphabet’s (NASDAQ:GOOGL) (NASDAQ:GOOG) unit, Google, is reportedly conducting tests for a new gaming product on its video streaming platform YouTube to boost revenue. The feature, titled “Playables,” will enable gaming enthusiasts to play video games directly on desktops as well as mobile devices running on Android and iOS systems, a Wall Street Journal report stated.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The report referred to an internal document within Google’s unit that invited employees to test the product on YouTube and gain constructive feedback on its functioning and gaming experience. Currently, Playables is running simple games such as the brick arcade game, Stack Bounce. Once the company is satisfied with the product’s performance, it will be launched to the public with a larger array of games and an improved user experience. The document did not state how Google will generate revenue from “Playables.” Alphabet usually follows this practice of testing new products internally and improvising before releasing them to the general public.

YouTube Struggles with Declining Ad Revenues

YouTube CEO Neal Mohan is concerned about the declining advertising revenues earned from a lull in advertising spending on its platform. Globally, advertising spending has taken a setback as companies try to navigate the challenging macro backdrop with structural changes and headcount reductions. With this backdrop, Mohan is trying to come up with newer avenues to boost revenue and attract a larger consumer base. Even so, the gaming industry has also faced a slowdown recently compared to the pandemic-era gaming boom when home-bound consumers turned to online gaming and other channels of in-house entertainment.

Data from Statista, an independent research firm, shows that the global revenue from the video game market is expected to reach $384.90 billion this year. Further, the revenue is expected to grow at a compound annual growth rate (CAGR) of 7.89% to reach $521.60 billion by 2027, with the majority of the contribution coming from mobile games. The figures display the sheer size and attractiveness of the video game market, and no wonder YouTube is vying to gain a share in the burgeoning space.

Is It Good to Buy Google Shares?

On TipRanks, GOOGL commands a Strong Buy consensus rating based on 28 Buys and three Hold ratings. The average Alphabet Class A price forecast of $131.48 implies 7.5% upside potential from current levels. This is over and above the 37.3% gain by GOOGL stock in 2023, thanks to the overall bullishness of the tech sector.

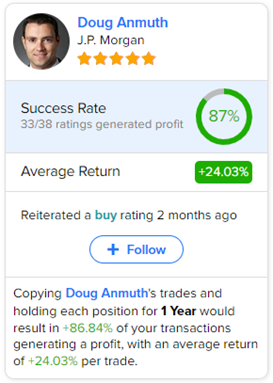

Moreover, investors looking for the most accurate and most profitable analyst for GOOGL could follow Doug Anmuth from JPMorgan. Copying his trades on this stock and holding each position for one year could result in 87% of your transactions generating a profit, with an average return of 24.03% per trade.