Antitrust lawsuits are not new for Alphabet- (NASDAQ:GOOGL)(NASDAQ:GOOG) owned Google due to its large scale and global operations. In a recent development, the internet giant is facing opposition from both sides of the pond: the U.S. Department of Justice (DOJ) and the European Commission (the top antitrust regulator of the European Union), on concerns over its ad-tech dominance. Both of these regulators are looking to break up Google’s ad-tech business.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The U.S. Department of Justice has filed several antitrust lawsuits about various aspects of its business, including advertising technologies and practices. In January, the DOJ joined several U.S. states in filing a lawsuit against the company for alleged antitrust practices.

The DOJ is seeking the breakup of its ad-tech business as it opines that the company abuses its dominance in the digital advertising industry to thwart competition, in turn hurting advertisers and publishers.

Legal Issues Compound for Google

Echoing similar sentiments, the European Commission could soon file a formal antitrust complaint against the tech giant, as a Wall Street Journal report highlighted. The regulator is also considering ordering Google to sell some parts of its ad-tech business as part of the lawsuit.

Earlier, Bloomberg reported that the regulator could file a complaint as soon as Wednesday.

The European Commission has already imposed fines on Google for its actions that infringed European competition law. However, each decision is under appeal.

While legal issues have compounded for Google, investors remain unfazed by these developments. Despite the buzz around the antitrust lawsuit, GOOGL stock closed higher on June 12.

Is GOOGL a Buy, Sell, or Hold?

While regulatory headwinds persist for GOOGL stock, analysts maintain a bullish outlook as the company could emerge as the biggest beneficiary of the AI (Artificial Intelligence) movement. The AI ramp-up could bring significant growth opportunities and drive its stock price higher.

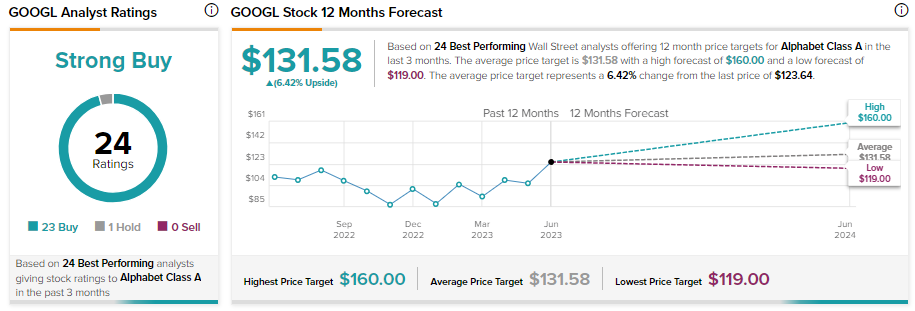

GOOGL stock is up about 40% year-to-date. Meanwhile, it has received a Strong Buy consensus rating from the Top Wall Street analysts. TipRanks identifies the top analysts per sector, per timeframe, and against different benchmarks.

Among the 24 top analysts giving ratings on GOOGL stock, 23 recommend a Buy, and one suggests a Hold. Further, these analysts’ average 12-month price target of $131.58 implies 6.42% upside potential from current levels.