Alnylam Pharmaceuticals (ALNY) has announced positive Phase 3 results from the ILLUMINATE-A study of lumasiran for the treatment of primary hyperoxaluria type 1 (PH1).

PH1 is an ultra-rare orphan disease caused by excessive oxalate production, and elevated urinary oxalate levels are associated with progression to end-stage kidney disease and other systemic complications.

The clinical data was presented at a virtual session of the European Renal Association-European Dialysis and Transplant Association (ERA-EDTA).

Lumasiran, an investigational RNAi therapeutic, achieved the primary endpoint with a 53.5% mean reduction in urinary oxalate relative to placebo (p=1.7×10-14) and showed a 65.4% mean reduction in urinary oxalate relative to baseline.

All tested study secondary endpoints were met, including the proportion of patients achieving near-normalization (84%) or normalization (52%) of urinary oxalate, compared with 0% in the placebo group.

Lumasiran also showed an encouraging safety and tolerability profile, with no serious or severe adverse events (AEs) and with mild injection site reactions as the most common drug-related AE.

Based on these results, Alnylam has now filed a New Drug Application (NDA) with the U.S. Food and Drug Administration (FDA). The FDA has granted a Priority Review for the NDA with a December 3, 2020 action date under the Prescription Drug User Fee Act (PDUFA).

In addition, the Marketing Authorisation Application (MAA) for lumasiran has received Accelerated Assessment from the European Medicines Agency (EMA).

The study “represents the sixth positive Phase 3 study for an investigational RNAi therapeutic, and we believe it further highlights the transformational potential of this modality as a whole new class of medicines” said Akshay Vaishnaw, President of R&D at Alnylam.

“Overall, we think the data is solid, consistent with prior Phase I/II, and we anticipate rapid approval by the December 3rd PDUFA date” RBC Capital analyst Luca Issi told investors following the data release.

However the analyst reiterated his Hold rating on the stock with a $150 price target, arguing that ALNY’s trailblazing phase 1 may actually end up providing a clearer path for rival Dicerna Pharma (DRNA)- which has a Strong Buy Street consensus.

“We think DRNA is better positioned for PH given: 1) better dosing (fixed vs. weight-based dosing); 2) potential for broader label (can tackle all PH subtypes vs. only PH1); and 3) DRNA may capitalize on ALNY’s heavy lifting on building disease awareness” Issi explained. He has a buy rating on Dicerna with a $35 price target (73% upside potential).

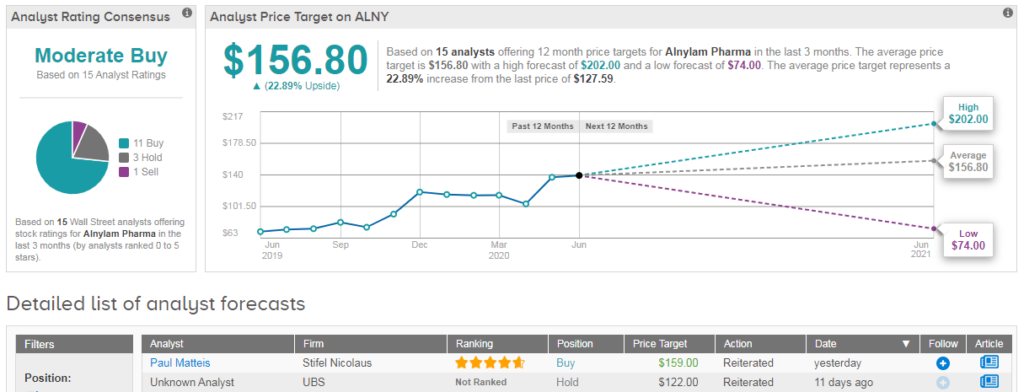

Analysts currently hold a cautiously optimistic Moderate Buy consensus on Alnylam with a $157 average price target (23% upside potential). The stock is currently trading up 11% year-to-date. (See ALNY stock analysis on TipRanks)

Related News:

AbbVie’s Rinvoq Beats Bristol-Myers’ Orencia In New Rheumatoid Arthritis Data

Teva Wins Court Ruling Against Opiant, Emergent Bio On Narcan Nasal Spray

5 Promising Covid-19 Vaccines Picked For Trump’s Operation Warp Speed