Digital financial services company Ally Financial Inc. (NYSE: ALLY) reported better-than-expected results for the quarter ended December 31, 2021. The strong results were driven by the growth witnessed in adjusted total net revenues.

However, following the earnings, shares of the company plunged more than 5% to close at $46.51 during Friday’s extended trade, which can be attributed to wider market concerns.

Revenue & Earnings

Ally Financial reported adjusted total net revenues of $2.2 billion, a growth of 17% from the prior year. The figure also comfortably outpaced the consensus estimate of $2.05 billion. This growth can be attributed to the 27% year-over-year growth witnessed in net financing revenues, which made up almost 76% of the total adjusted net revenues of the company.

The company reported quarterly adjusted earnings per share (EPS) of $2.02, which denotes a 26.3% growth from the prior year. Moreover, the figure surpassed the consensus estimate of $1.95.

Other Operating Metrics

The company reported an adjusted tangible book value per share of $38.73 at the end of the quarter, compared to $36.05 reported at the end of the prior year.

However, the company’s adjusted efficiency ratio dropped to 44.4% from the previous year’s figure of 49.8%.

Management Commentary

CEO of Ally Financial, Jeffrey J. Brown, said “We generated the highest total revenue, PPNR and net income levels, added new product capabilities, and surpassed 10 million total customers across the wide array of Ally products. I’m incredibly proud of the 10,400 teammates who operate under a ‘Do It Right’ approach delivering differentiated products and services every day. The success we achieved in 2021 reflects years of focused execution resulting in growing momentum across our businesses and positions us well for continued dynamic operating environments.”

Analyst Ratings

Wall Street’s Top Analysts have awarded Ally Financial a Strong Buy consensus rating based on 9 Buys and 2 Holds. The average Ally Financial price target of $62 implies upside potential of 31.75% from current levels. Shares have gained 19.6% over the past year.

TipRanks Website Traffic

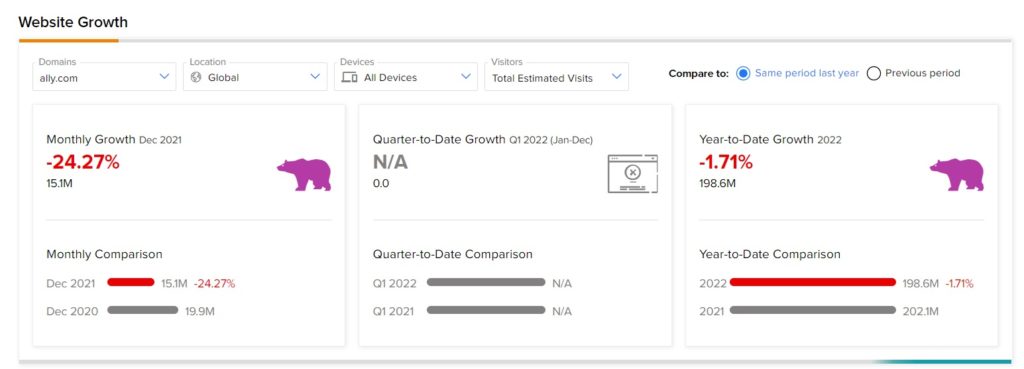

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Ally Financial’s performance this quarter.

According to the tool, the Ally Financial website recorded a 24.27% monthly decline in global visits in December, compared to the same period last year. Moreover, year-to-date, website traffic fell 1.71%, compared to the previous year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Google Appeals to Overturn EU Antitrust Fine of $2.8B

Twitter Launches NFT Profile Pictures

Intel to Invest $20B in Mega Chip Factories in Ohio