Chinese e-commerce giant Alibaba (NYSE:BABA) declined in pre-market trading even as the company’s adjusted diluted earnings came in at $2.14 or RMB15.63 per American Depository Share (ADS), up by 21% year-over-year in the Fiscal second quarter. This was above analysts’ expectations of earnings of $2.11 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s Q2 revenues increased by 9% year-over-year to $30.8 billion as compared to analysts’ consensus estimates of $30.9 billion.

In a surprise move, Alibaba stated it was not going ahead with a “full spin-off” of its Cloud Intelligence unit and would instead “focus on developing a sustainable growth model for Cloud Intelligence Group under the fluid circumstances.” The company explained that given the restrictions placed by the U.S. on semiconductor manufacturing equipment and computing chips, these could adversely impact the “Cloud Intelligence Group’s ability to offer products and services and to perform under existing contracts.”

Additionally, Alibaba announced that its Board of Directors had approved an annual cash dividend for FY23 of $0.125 per ordinary share or $1.00 per ADS, payable in U.S. dollars, to holders of ordinary shares and holders of ADSs, as of the close of business on December 21, 2023.

Is BABA a Buy or Hold?

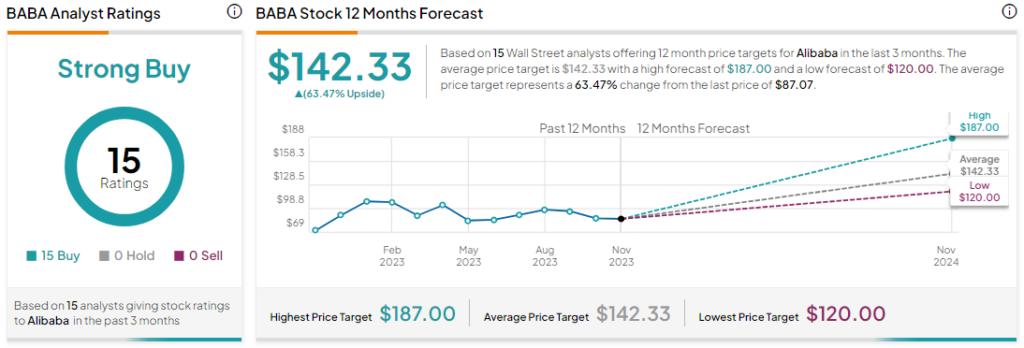

Analysts remain bullish about BABA stock with a Strong Buy consensus rating based on a unanimous 15 Buys. Even as BABA has gained by around 11% in the past year, the average BABA price target of $142.33 implies an upside potential of 63.5% at current levels.