Chinese e-commerce giant Alibaba Group (NYSE:BABA) has announced another major leadership shake-up. Former CEO Daniel Zhang has unexpectedly announced his departure from the role as the head of the company’s cloud intelligence unit. This decision contrasts with BABA’s announcement in June that Zhang was stepping down as the company’s CEO to concentrate on the cloud business.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Leadership Transition at Alibaba

Zhang joined Alibaba in 2007 and is renowned for leading the company’s highly successful “Singles Day” shopping festival. He subsequently took on the role of group CEO in 2015 and chairman in 2019, succeeding co-founder Jack Ma.

It is worth mentioning that Zhang will remain involved in Alibaba’s future growth, albeit in a different capacity. He is establishing a technology fund, with Alibaba planning to invest $1 billion in it.

Meanwhile, the company’s new CEO Eddie Yongming Wu will be assuming the roles of acting chairman and the head of the cloud unit.

The leadership transition occurs ahead of the scheduled spin-off of AliCloud, which could potentially impact its timing. Nevertheless, Alibaba said it will proceed with the cloud unit’s IPO under a new management team that will be appointed.

Is BABA a Buy or Hold?

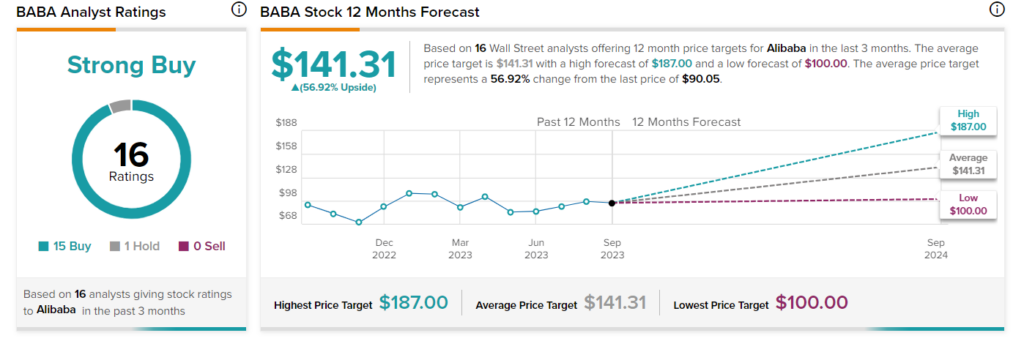

On TipRanks, BABA stock has a Strong Buy consensus rating based on 15 Buys and one Hold. The average stock price target of $141.31 implies 56.9% upside potential. Shares are down 2.1% so far in 2023.