Chinese tech giant Alibaba Group Holding Ltd. (BABA) is considering selling its 30% stake in the social media company Weibo Corp. (WB), as per Bloomberg. Following the news, shares of BABA fell 2.4%, closing at $112.09, while WB shares slipped 3.5% and closed at $28.52 on December 29.

Alibaba In Talks with Shanghai Media Group

According to the report, Alibaba is in preliminary talks with the state-owned conglomerate Shanghai Media Group (SMG) to sell all of its 30% stake in Weibo.

Amid regulatory overhauls and increased scrutiny by the Chinese government, tech companies are finding ways to avoid attracting more attention. BABA’s step to offload its stake follows the news of Tencent Holdings Ltd’s. (TCEHY) recent sell-off of its stake in tech company JD.com Inc. (JD).

The Chinese government is worried about the influence these media companies have on people and does not want any single company having a majority hold in any of the technology segments.

Since SMG is a state-owned company, it stands higher chances of getting Beijing’s approval compared to any private acquirer. SMG also has a majority stake in Oriental Pearl Group Co. which has television stations, online portals along with a 20% stake in the Shanghai Disney Resort.

Weibo being an open platform for people to share their opinions and express their views, comes directly under the government’s radar. Shedding its stake from Weibo is in line with the government’s directives to shed some of its stake from social media companies, as reported in March.

Consensus View

Recently, Daiwa analyst John Choi lowered the price target on BABA stock to $170 (51.7% upside potential) from $195, while maintaining a Buy rating.

Choi believes the increased competition in the e-commerce market is a big risk for BABA in both its home market and abroad. BABA earnings for the third quarter of fiscal year 2021 are scheduled for February 2, 2022.

Overall, the stock commands a Strong Buy consensus rating based on 20 Buys and 3 Holds. The average Alibaba price target of $203.05 implies 81.2% upside potential to current levels. Shares have lost 53% over the past year.

Website Traffic

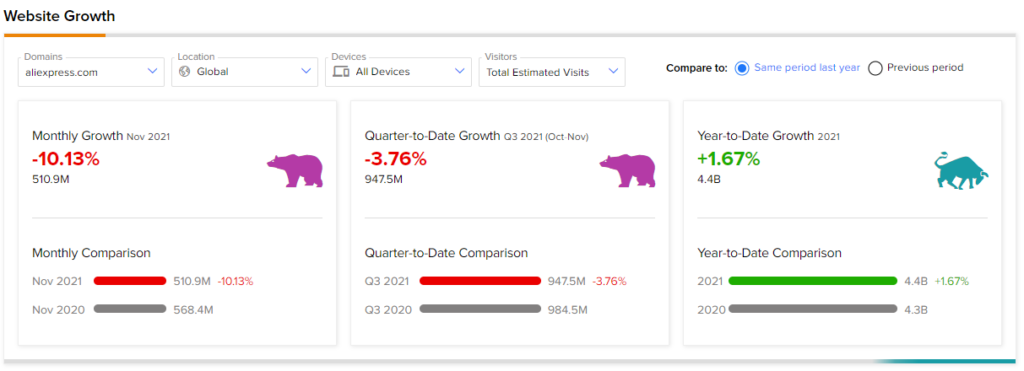

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into BABA’s performance.

In November, Alibaba website traffic recorded a 10.13% year-over-year decline in monthly visits. However, year-to-date website traffic growth increased by 1.67% compared to the same period last year.

Related News:

Delta, Alaska Cancel More Flights Amid Rising Omicron cases

Vera Bradley Updates 2 Key Risk Factors

AstraZeneca & Ionis Conclude Eplontersen Commercialization Agreement