XPeng Motors delivered a total of 3,040 of its smart electrical vehicles (EVs) in October, a whopping 229% increase year-over-year. Shares are up more than 8% in Monday’s pre-market trading.

XPeng (XPEV) deliveries consisted of 2,104 P7s, the company’s smart sports sedan, and 936 G3s, its smart compact SUV. On a month-to-month comparison, delivery numbers declined from the month of September, during which the company delivered a record of 3,478 EVs.

“Despite China’s Golden Week holiday in early October which affected deliveries, the Company sees strong business momentum supported by fast production ramp up and robust demand for its Smart EVs,” XPeng said in a statement.

The Chinese smart electric vehicle company said it achieved a new milestone by completing the production of 10,000 of its P7s on October 20, just 160 days after starting mass production of the vehicles.

Since the beginning of the year until October 31, deliveries of XPeng’s smart EVs amounted to 17,117 units, representing a 64% increase year-over-year.

Back in July, the company raised $500 million with a group of investors including Aspex, Coatue, Hillhouse Capital and Sequoia Capital China.

XPeng, which is backed by Alibaba, was co-founded in 2014 by Xiaopeng, former president of Alibaba Mobile Business Group, together with Xia Heng and He Tao, former technology leaders of Guangzhou Automobile Group Engineering.

At the end of August, XPeng began trading on the New York Stock Exchange after its $1.5 billion initial public offering at an offering price of $15 per ADS. Shares closed 6.5% lower at $19.38 on Friday. (See XPEV stock analysis on TipRanks)

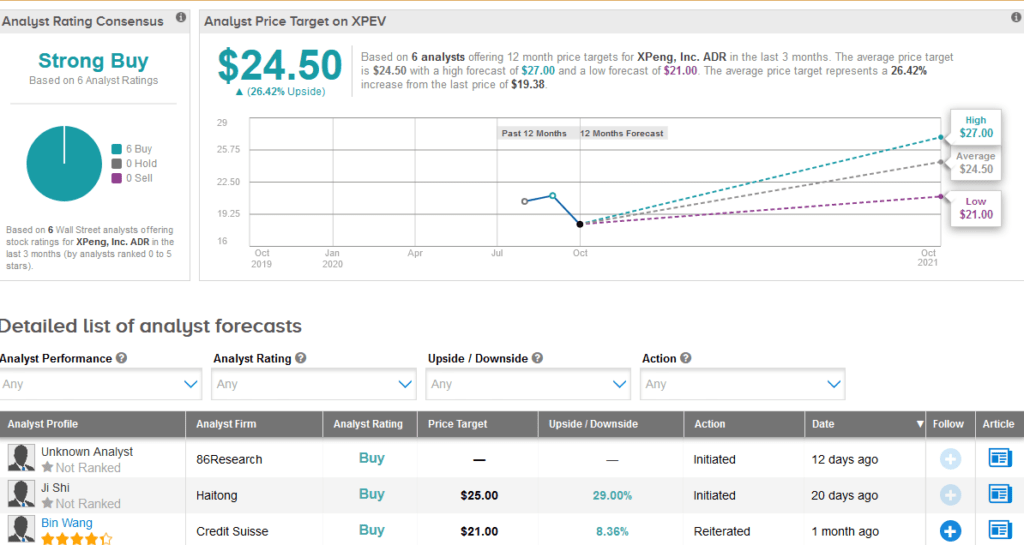

The stock has recently attracted ample attention as more analysts initiated its coverage. XPEV has picked up 6 recent back-to-back Buy ratings, which add up to a Strong Buy analyst consensus. Meanwhile, the $24.50 average price target implies 26% upside potential over the coming year.

J.P. Morgan analyst Nick Lai recently started the stock’s coverage with a Buy rating and a $27 price target, arguing that XPeng offers vehicles at “competitive prices” that “can capture a sizable and fast-growing addressable market.”

“We expect XPeng … to benefit from and lead China’s multi-year smart-EV trend, where we forecast penetration tripling from less than 5% in 2019 toward 13% or higher by 2025,” Lai wrote in a note to investors.

The analyst expects XPeng’s revenue to grow at a “robust” compound annual growth rate of 73% through 2025.

Related News:

Nio Deliveries Double In October; JP Morgan Upgrades To Buy

Facebook Drops 6% on ‘Uncertain’ 2021 Warning; J.P. Morgan Raises PT

Under Armour’s 3Q EPS Top Estimates On Footwear Demand; Street Says Hold