Shares of food and drug retailer Albertsons Companies, Inc. (ACI) have gained 77.4% over the past 12 months. Driven by a favorable economic environment, retail price inflation, and incremental sales, ACI delivered a robust third-quarter performance earlier this week.

Meanwhile, the company also witnessed higher labor and logistics costs coupled with supply chain challenges, leading to gross margin contraction during the quarter.

Furthermore, ACI has declared a dividend of $0.12 per share for the fourth quarter, payable on February 10 to investors on record as of January 26.

With these developments in mind, let us take a look at the changes in ACI’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, Albertsons Companies’ top risk category is Finance & Corporate, contributing 40% (compared to a sector average of 39%) to the total 50 risks identified. In its recent quarterly report, the company has changed one key risk factor under the Finance & Corporate risk category.

ACI noted that its stock price could deflate if a significant number of its shares are sold in the market, or if a perception is created that stockholders might sell ACI shares. A decreased share price could make it difficult to raise capital through additional share issuance.

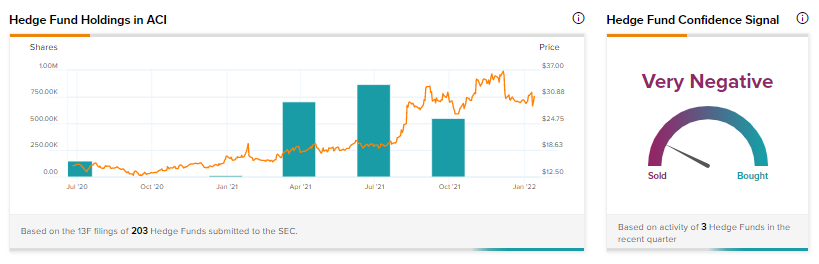

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have decreased their holdings in Albertsons Companies by 320.6 thousand shares in the last quarter, indicating a very negative hedge fund confidence signal in the stock based on activities of three hedge funds in the recent quarter.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Albertsons Shares Tumble 9.7% Despite Q3 Beat & Raised Outlook

Nokia Confident to Beat 2021 Guidance; Initiates FY2022 Margin Outlook

Novavax COVID-19 Vaccine gets Approval in South Korea