Shares of Albemarle dropped 2.8% in Tuesday’s extended market trading session after the global producer of lithium announced the launch of a $1.3 billion stock sale to fund its growth expansion plans and pay down debt.

Specifically, Albemarle (ALB) disclosed that the sale proceeds will be used to fund the construction and expansion of its lithium operations in Australia, Chile and Silver Peak, Nevada, as well as opportunities in China. In addition, the lithium producer seeks to use the net proceeds for debt repayment in the short-term and other general corporate purposes.

Albemarle said it expects to provide the underwriters of the public offering with a 30-day option to purchase up to $195,000,000 of additional shares at the offering price, less the underwriting discounts and commissions.

Looking ahead to this year, the lithium producer forecasted an improved full-year 2021 performance relative to 2020 amid expectations for a continued economic recovery following the COVID-19 pandemic.

In a separate statement, Albemarle announced preliminary fourth-quarter results. The company projects net sales of between $870 million and $880 million in 4Q compared to analysts’ estimates of of $836 million. Adjusted EPS was guided at between $1.11 and $1.19 versus the Street consensus of $1.07.

“We expect our Lithium business to experience lower pricing, offset by higher volumes. Higher Lithium costs related to project start-ups are expected to be partially offset by efficiency improvements,” Albemarle stated. “Bromine results are expected to be up on higher volumes with on-going savings initiatives expected to offset inflation.”

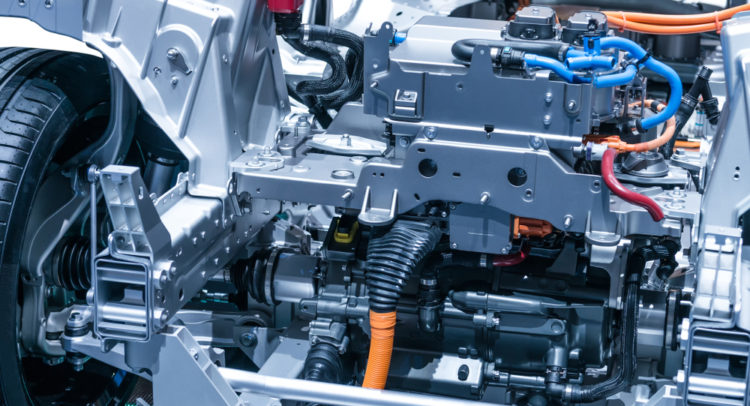

Shares of Albemarle have been on a stellar run, surging 81% over the past three months as the need for lithium-ion batteries is growing, driven by the global demand for electric vehicles, mobile devices and grid storage. (See Albemarle stock analysis on TipRanks)

Nonetheless, Oppenheimer analyst Colin Rusch reiterated a bullish call on the stock with a $111 price target, as he expects the capital raise to be used for shoring up the company’s capital spending to grow lithium capacity.

“Given OEM commitments to increasing EV sales and concerns around material availability to support those ramps, we expect ALB is actively working to complete sales agreements for that capacity to ensure visibility on sufficient returns for those facilities,” Rusch wrote in a note to investors. “We continue to have a constructive bias on EV unit growth and the importance of low-cost, high quality lithium concentrates for advanced battery chemistries to enable EV adoption and see ALB as a leader in the lithium industry.”

Following the stock’s sharp rally, the rest of the Street remains sidelined on the stock with a Hold consensus rating. That’s with an average analyst price target of $119.73, implying 29% downside potential lies ahead over the coming 12 months.

Related News:

AstraZeneca To Supply Another 9M COVID-19 Vaccine Doses After EU Nod

Microsoft’s Cloud Services Fuel 2Q Sales Beat; Shares Rise

Starbucks’ Profit Outlook Disappoints; Shares Fall