Alarm.com on Dec. 14, announced the acquisition of indoor gunshot detection technology provider, Shooter Detection Systems (SDS). Shares rose 4.1% in Tuesday’s trading.

Financial terms of the deal weren’t disclosed. Alarm.com, (ALRM) which offers cloud-based services for remote control, home automation, and monitoring services, said that the acquisition will play a crucial role in the expansion of its commercial plans and provide premier gunshot detection solutions to its partners’ customers.

Under the terms of the deal, SDS will become a subsidiary of Alarm.com and continue to be led by its current management team. The gunshot detection technology provider will also continue to support its present customers and partners.

Alarm.com and SDS will work towards the advancement of SDS’ engineering and the development of its gunshot detection solutions.

“Acquiring SDS allows us to tap into their established resources and give our partners the opportunity to capture the active shooter solutions market.” said Alarm.com’s chief strategy officer Jeff Bedell.

ALRM’s stock price has gained 82.1% year-to-date and is trading at a discount of 3.4% to its 52-week high. (See ALRM stock analysis on TipRanks)

Last month, Alarm.com reported 3Q revenue, which increased 24.2% year-on-year to $159 million, beating analysts’ estimates by $29.3 million. EPS grew 32.4% to $0.49, exceeding Street estimates by $0.18.

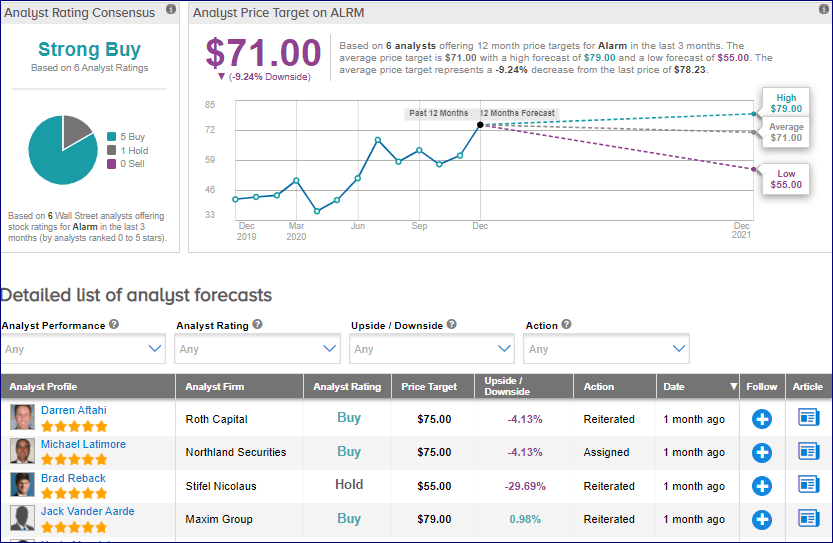

On Nov. 9, Maxim Group analyst Jack Vander Aarde reiterated a Buy rating on the stock with a price target of $79.

Arde’s expects the company to have a North America residential subscriber base of 9 million, an international residential subscriber base of 4 million, and commercial subscriber base of 1 million in 2029.

Overall, the stock has a Strong Buy analyst consensus based on 5 Buys and 1 Hold. Following this year’s sharp rally, the average price target of $71 implies downside potential of 9.2% to current levels.

Related News:

Trinseo Snaps Up Arkema’s Acrylics Business For $1.36B; Analyst Sticks To Buy

Eli Lilly Ramps Up Dividend By 15%; Stock Up 20% YTD

Vivendi In Exclusive Talks To Acquire Prisma; Street Is Bullish