Akoustis Technologies, Inc. (AKTS) provides acoustic wave radio frequency filters for mobile and other wireless markets. In its recent second-quarter showing, Akoustis notched a triple-digit growth in its top line.

Buoyed by robust demand, revenue increased 180.7% year-over-year to $3.7 million, but still fell short of estimates by $31.2 thousand. Net loss per share at $0.23 came in line with estimates. Notably, the company achieved top-line growth amid COVID-19 and semi-conductor supply chain challenges.

Further, Akoustis is ramping up the production of its XBAW RF filter solutions. It plans to increase its annual production capacity to 500 million filters annually.

With these developments in mind, let us take a look at the changes in Akoustis’ key risk factors that investors should know.

Risk Factors

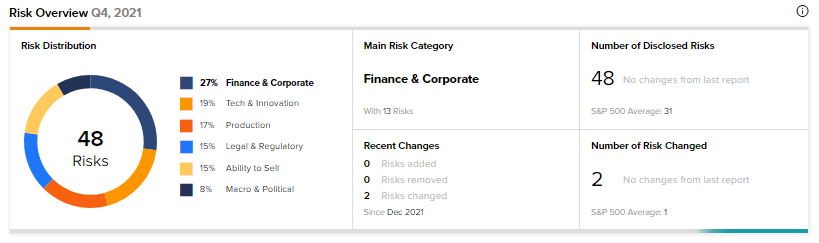

According to the TipRanks Risk Factors tool, Akoustis’ top risk category is Finance & Corporate, contributing 27% (compared to a sector average of 48%) to the total 48 risks identified. In its recent report, the company has changed two key risk factors.

Under the Finance & Corporate risk category, Akoustis noted that it acquired a majority stake in RFM Integrated Device in October 2021. Akoustis also has the right to acquire the remaining 49% stake in RFM until June 30, 2022. Akoustis may also engage in acquisitions or investments in the future. The risk remains that such an activity could disrupt its business, dilute existing investors, or affect its financial condition.

Under the Tech & Innovation risk category, Akoustis highlighted that the semiconductor industry is marked by pursuit and protection of intellectual property rights. The company is and may in the future be subject to infringement claims, misuse of third-party IP rights, which could mean substantial expenses, and potential loss of IP rights for Akoustis.

Tracking Insiders

Keeping a tab on insiders stocks can provide timely insights for retail investors. According to TipRanks data on Insider Activity, insiders have sold Akoustis shares worth $97.6 thousand in the last three months, indicating a negative insider confidence signal for the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Sony Acquires Bungie for $3.6B; Shares Up 4.5%

Graco Reports Q4 Beat; Shares Surge 6%

Fabrinet Delivers Upbeat Results in Fiscal Q2