Akamai Technologies, Inc. (AKAM) has delivered better-than-expected results for the fourth quarter of 2021 on the back of higher demand for its security products. Despite the upbeat performance, AKAM stock declined 5.4% in Tuesday’s extended trading session.

Results

Adjusted earnings of $1.49 per share, rose 12% from $1.33 in the last year’s quarter. Also, it beat the consensus estimate of $1.42 per share. Revenues increased 7% year-over-year to $905 million, outpacing estimates of $899.6 million. The upside can be attributed to solid growth in Security Technology Group revenue.

Adjusted EBITDA for the fourth quarter was $404 million, up 11% from the same quarter last year. Notably, cash generated from operations for the fourth quarter stood at $387 million, or 43% of revenue.

For 2021, Akamai delivered revenues of $3.5 billion, up 8% year-over-year. Further, adjusted earnings grew 10% to $5.74 per share.

Linode Acquisition

Alongside earnings, Akamai revealed plans to acquire Linode, an infrastructure-as-a-service (IaaS) platform provider. The deal is expected to close in the first quarter of 2022, subject to customary closing conditions.

As per the agreed terms, Akamai will acquire all the outstanding equity of Linode for about $900 million. The company also disclosed that it has structured the transaction as an asset purchase due to which it expects to achieve cash income tax savings over the next 15 years that have an estimated net present value of nearly $120 million.

In 2022, the acquisition is anticipated to add about $100 million in revenue and be slightly accretive to adjusted EPS by approximately $0.05 to $0.06.

The CEO and Co-founder of Akamai, Dr. Tom Leighton, said, “The opportunity to combine Linode’s developer-friendly cloud computing capabilities with Akamai’s market-leading edge platform and security services is transformational for Akamai… This is a big win for developers who will now be able to build applications on a platform that delivers unprecedented scale, reach, performance, reliability and security.”

Stock Rating

Based on 5 Buys, 2 Holds and 1 Sell, the stock has a Moderate Buy consensus rating. The Akamai stock price prediction of $136.86 implies 23.2% upside potential from current levels. Shares have gained 4.3% over the past year.

Positive Sentiment

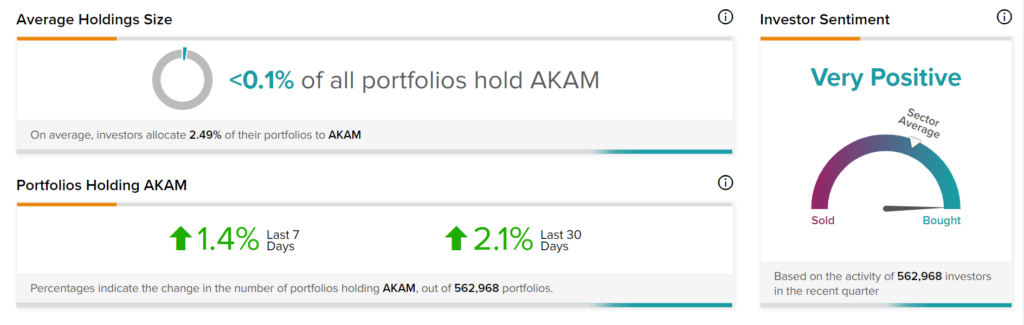

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Akamai, as 2.1% of investors on TipRanks increased their exposure to AKAM stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Fidelity to Enhance Embedded Payments for SMBs with Payrix Deal

Weber Posts Poor Q1 Results; Misses Estimates

3M Company Provides Outlook for 2022