Airbus Group SE has won a €491 million ($576 million) contract by the European Space Agency (ESA) for the earth return orbiter (ERO) – the first ever spacecraft to bring samples back to earth from Mars.

As the prime contractor, Airbus (EADSF) will design and build the ERO for the Mars Sample Return (MSR) mission, which is a joint ESA-NASA campaign aiming at Mars exploration. MSR is a set of three separately launched missions, which together have the objective of returning Mars samples to earth before the end of 2031.

“The five-year mission will see the spacecraft head to Mars, act as a communication relay with the surface missions, perform a rendezvous with the orbiting samples and bring them safely back to earth,” Airbus said in a statement.

For ERO, Airbus will use its autonomous rendezvous and docking expertise built up over decades of experience in optical navigation, using technologies from the successful ATV (Automated Transfer Vehicle) and recent developments from JUICE, Europe’s first mission to Jupiter.

To be launched on an Ariane 6 in 2026, the 6 ton, 6 m high spacecraft, will take about a year to reach Mars. Airbus will have overall responsibility for the ERO mission, developing the spacecraft in Toulouse, and conducting mission analysis in Stevenage. Thales’ subsidiary Thales Alenia Space Turin will assemble the spacecraft, develop the communication system and provide the orbit insertion module.

Shares in Airbus have lost almost 50% of their value this year as airline travel has fallen off a cliff due to lockdown restrictions forcing many airlines around the world to ground the majority of their fleets and to sharply reduce spending. This has resulted in a deep cut in the number of commercial jets planemakers’ customers need over the next few years with some asking for delivery delays or order cancellations.

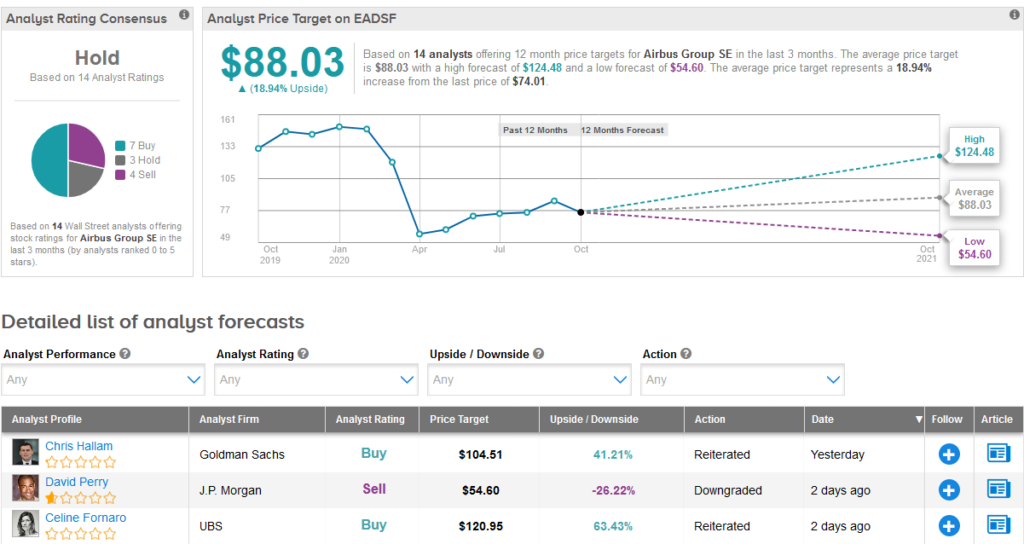

Looking ahead, it looks like Wall Street analysts expect some recovery in the shares over the coming year, with the average price target set at $88.03, which translates into 19% upside potential to current levels.

J.P. Morgan analyst David Perry this week downgraded the stock to Sell from Hold with a $54.60 price target (26% downside potential). The analyst sees a “significantly deteriorating” outlook for global air traffic and airline profits in 2021.

The rest of the Street is sidelined on the stock. Out of 14 recent analyst reviews, 3 have Hold ratings, 4 have Sell ratings, and 7 have Buy ratings, which add up to a Hold consensus. (See Airbus stock analysis on TipRanks).

Related News:

Boeing Sept. Deliveries Drop, No New Orders; Shares Down 3%

Delta Sinks On Huge Q3 Loss As Covid-19 Hurts Travel Demand

Southwest Airlines To Expand Footprint In Chicago and Houston