Air Canada’s (ACDVF) proposed bid for tour operator Transat is being challenged by European regulators amid concern that the deal may hamper air traffic competition between European countries and Canada, leading to higher prices for consumers.

The European Commission opened an in-depth investigation to assess the proposed acquisition and will announce its decision on Sept. 30. Back in August, Air Canada shareholders approved the C$720 million acquisition of Transat, which operates Air Transat.

In a statement, the Commission said it is concerned that the proposed transaction could significantly reduce competition on 33 origin and destination (O&D) citypairs between European Economic Area countries and Canada. These include 29 O&Ds where both companies offer direct services.

“We will carefully assess whether the proposed transaction would negatively affect competition in these markets leading to higher prices, reduced quality or less choice for travellers flying over the Atlantic,” said Executive Vice-President Margrethe Vestager, responsible for European Union competition policy. “This is a challenging time, especially in markets severely impacted by the coronavirus outbreak, but a return to normal and healthy market conditions must be based on markets that remain competitive.”

The Commission added that it will investigate the extent to which the coronavirus crisis would impact Air Canada, Transat and their competitors’ operations and hence the competitive landscape in the mid- and long-term.

In response to the probe, Transat said that it had notified Air Canada that it plans to postpone the outside date set for the transaction by one month to July 27. As a result, the company now expects the deal to close in the fourth quarter of this year.

Shares in Air Canada dropped 2% to $11.93 in U.S. trading on Friday. The stock is down 67% year-to-date.

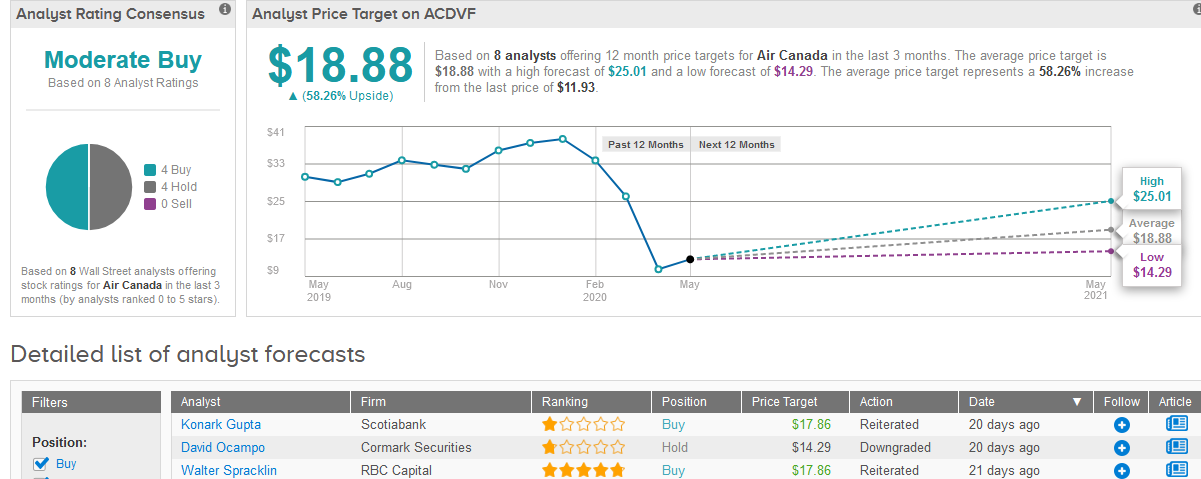

Wall Street analysts have a cautiously optimistic outlook on the stock. The Moderate Buy consensus is based on 4 Buy ratings and 4 Hold ratings. In light of the recent plunge in the shares, the $18.88 average price target reflects 58% upside potential in the coming 12 months.

Related News:

Latam Airlines Files For Chapter 11 Bankruptcy Protection In U.S.

Ryanair Cuts Traffic Target By Almost 50% For Coming Year, Seeks To Reduce Boeing Plane Deliveries

Boeing Gets No Orders in April, Customers Cancel 737 MAX Jets