Telehealth platform Hims & Hers Health (HIMS) is scheduled to announce its third-quarter earnings after the market closes on Monday, November 3. Despite declining 22% over the past month due to insider selling and other reasons, HIMS stock is still up about 83.4% year-to-date. While the company is expanding into international markets and lucrative areas such as testosterone and menopause support, Wall Street is currently cautious about HIMS stock due to concerns about intense competition and legal and regulatory risks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ahead of the Q3 results, the company announced its plans to roll out new GLP-1 “microdosing treatments.”

Meanwhile, Wall Street expects Hims & Hers Health to report Q3 earnings per share (EPS) of $0.09, compared to $0.32 in the prior-year quarter. Revenue is estimated to grow 44.5% year-over-year to $580.24 million.

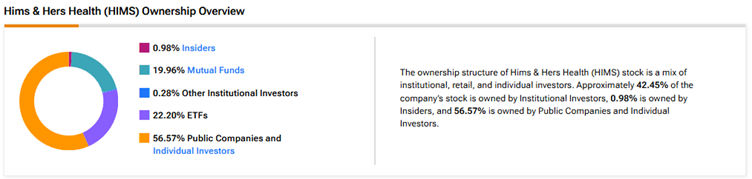

Now, according to TipRanks’ Ownership Tool, public companies and individual investors hold the largest share of HIMS at 56.57%. They are followed by ETFs, mutual funds, insiders, and other institutional investors at 22.2%, 19.96%, 0.98%, and 0.28%, respectively.

Digging Deeper into HIMS’ Ownership Structure

Looking closely at the top shareholders, Vanguard owns the largest stake in Hims & Hers Health at 7.52%. It is followed by iShares, which owns 7% of the company.

Among the top ETF holders, iShares Core S&P Mid-Cap ETF (IJH) owns a 3.03% stake in HIMS, followed by the Vanguard Total Stock Market ETF (VTI) with a 2.49% stake.

Moving to mutual funds, Vanguard Index Funds holds about 6.97% of Hims & Hers Health. Meanwhile, Growth Fund of America owns 4.7% of the company.

Is HIMS Stock a Good Buy?

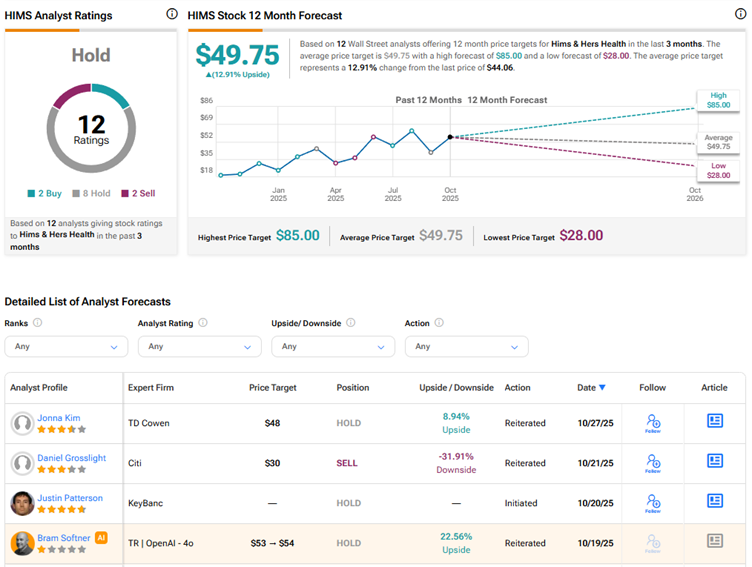

Heading into Q3 earnings, Wall Street has a Hold consensus rating on Hims & Hers Health stock based on eight Holds, two Buys, and two Sell recommendations. The average HIMS stock price target of $49.75 indicates about 13% upside potential.